Why early repayment of House Building Loan is bad for your financial health Part 1

- Tue Sep 21 18:30:00 UTC 2021

- In Personal Finance by Malhar Majumder

Key Takeaways:

- Start Investing Early / Pay Loan Late

- How much you take versus how much you pay

- How money loses value over time

A number of our clients referred me to few videos getting populated in the internet, where the protagonist creates strategies to close Home Loans early. The same protagonists in other videos freely preaches the principle of 'Start Investing Early'. While I completely agree with them about starting early, I am not sure why they are ignoring the natural corollary of Starting Early should be Paying Late. Hence for all my friends who referred me and seek my opinion on what needs to be done, let me present the facts and leave the judgment to the readers.

A loan can be classified as Good, Bad and Ugly depending on how it can affect the financial health of the seeker over a period of time. It is easier to grasp the concept with a few examples:

With a Good Loan, you are creating an appreciating asset. The loan may also enjoy subsidised rates and tax advantages. Example is Home Loan and Business Loan for Capital Expenditure.

A Bad Loan is unhealthy but not deadly. It is sometime necessary like Car Loan. You are buying a Depreciating Assets. The cost of loan is higher than a Good Loan and you don't enjoy any special favour from the taxman.

An Ugly Loan can damage the financial wellbeing of the seeker. Example could be a Credit Card rollover or a Stock Market leverage. Loans come with extreme high cost and horrific terms that are embedded somewhere deep in the loan documents. Stay away from them at any cost.

Is Home Loan really good?

Let's look at Mr Niraj who would like to avail a Home Loan. He is in the 30% income tax bracket. Wife is a home-maker with a couple of school going kids. He is from Kolkata but taken a decision to settle in Pune, and wish to by an Apartment. He is seeking a Home Loan of Rs. 1 Crore and got an offer of 6.75% per annum. He has the option of loan tenures of 15 years, 20 years or 25 years.

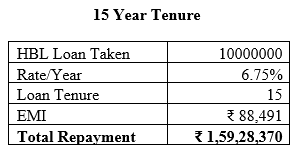

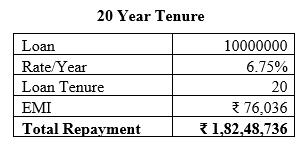

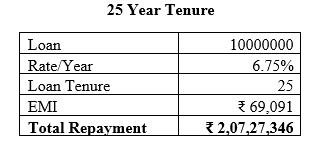

The Get Vs Pay Equation

A simple reading suggests that Mr Niraj ends up paying an extra amount of 23 lakhs to 48 lakhs depending on whether he closes the loan in 15 years or stretch it another 5 or 10 years. But …..yes there is but, which is too important to avoid.

Inflation factor

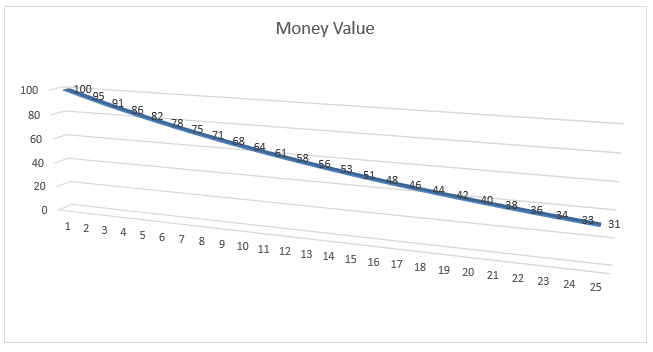

In 2010 Mr Niraj bought his first pair of sport shoes at Rs. 1000/-. Well in 2021, the same pair, of-course looking more awesome but delivering the same purpose costs Rs. 3000/-. We all know money loses its purchasing power over time due to inflation. Therefore, we must factor inflation into the loan repayment calculations above. After all INR 1 crore in 2041 is not same as INR 1 crore of 2021.

How quickly money value loses from Rs. 100 of 2021 to Rs. 31 in 2045 @ 5% inflation

Tax Factor

A House Building Loan enjoys favourable Income Tax treatment. Mr Niraj, who is in the 30% Income Tax bracket can save an additional income tax of Rs. 60000/- per year. This is an obvious benefit, which we need to factor in.

In the next blog post, we will discuss the implications of Inflation and Income Tax to enable you to take an informed financial decision. Till then........

Read the 2nd part of the article

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts