-A GUIDE TO REGULAR MONTHLY CASH FLOW

WHAT IS A SYSTEMATIC WITHDRAWAL PLAN?

Everyone has unique financial needs, which leads to various approaches to investing. Some individuals prefer to invest a large sum all at once, while others opt to contribute smaller amounts gradually. While some are focused on growing their wealth, others prioritize receiving regular returns. To accommodate these diverse goals, fund companies provide a range of investment tools.

One such tool is the Systematic Withdrawal Plan (SWP). SWPs are an effective strategy for investors to obtain a consistent income from mutual funds. These plans allow investors to withdraw a set amount on a regular basis, ensuring a dependable cash flow that is especially advantageous for retirees. Additionally, SWPs aid in tax management by distributing capital gains over time and offer flexible withdrawal frequencies—whether annually, quarterly, or monthly—automating the cash-out process and removing the necessity to manually sell units. While they offer stable income, it’s essential to keep in mind that regular withdrawals may impact the overall value of the mutual fund investment.

HOW TO USE A SWP?

PICK A MUTUAL FUND - To begin, you select a mutual fund for your investment, similar to picking a savings jar to hold your money.

OPEN AN ACCOUNT - You need to open an account with the mutual fund company, similar to opening a bank account.

DECIDE HOW TO INVEST - You decide whether you want to put money into this fund all at once (lump sum) or bit by bit over time (SIP).

SET UP SWP - You then tell the mutual fund company/ distributor that you want to withdraw a fixed amount of money regularly (monthly, quarterly, etc.). This is like setting up a plan to take out a certain amount from your savings jar at regular times.

WITHDRAW MONEY - When the withdrawal date you selected arrives, the mutual fund company will withdraw the specified amount by selling a portion of your mutual fund. This process effectively converts some of your investments into cash.

MONEY TO BANK ACCOUNT - The proceeds from the sale are deposited into your bank account, much like putting cash from a savings jar directly into your wallet.

THE PROCESS CONTINUES - This process keeps happening at the intervals you chose (every month, every three months, etc.) until you stop (cease) it, or your investment runs out.

EARNING RETURNS - Meanwhile, the money that remains in the mutual fund continues to grow (or shrink) based on how well the investments are doing. Over time, as you keep taking money out, the total amount left in your portfolio may decrease.

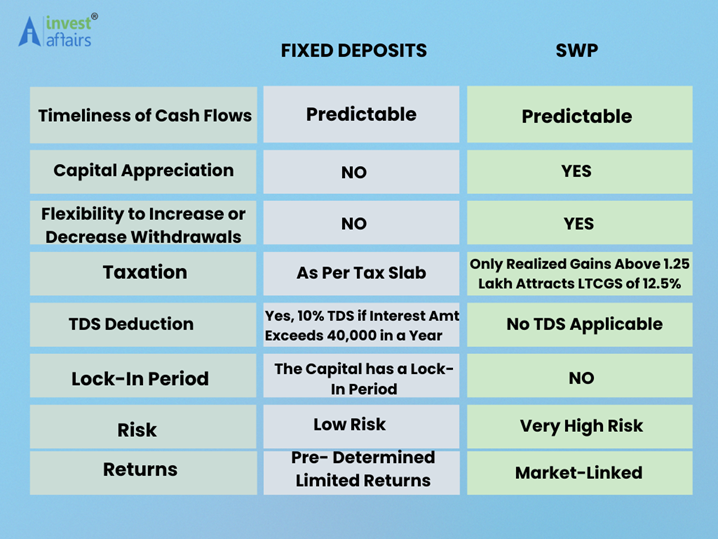

HOW DOES SWP COMPARE WITH A FIXED DEPOSIT?

SWP may be a better option for those who need a steady stream of income and are willing to accept fluctuating returns, while FD may be a better option for those who want a guaranteed return on their investment and are willing to lock their money for a certain period of time.

THE 4% RULE

Many retirees apply the 4% rule to decide their withdrawal amounts. This guideline indicates that withdrawing a maximum of 4% of your retirement savings each year can help ensure that your funds last throughout your retirement.

Let us assume you have saved ₹1,00,00,000 for retirement.

According to the 4% rule:

Annual Withdrawal: ₹1,00,00,000 x 4% = ₹4,00,000 per year

Now let’s see how you can benefit from the 4% Rule in SWP:

Set Up SWP in Your Mutual Fund (portfolio):

Divide the annual withdrawal amount by 12 to get the monthly withdrawal amount.

In this case your monthly withdrawal: ₹4,00,000 / 12 = ₹33,333

Expected Growth of Investment: Even though you are withdrawing ₹4,00,000 annually, the remaining corpus continues to grow at an estimated rate of 12% to 15%. This is the most important feature of the systematic withdrawal pan. For more information and insight on SWP we will request you to meet up with our experts. We also have provisions in our website whereby you can use various tools to find out your projected requirements and /or disciplined investments you need to make based on your goals. Please click here to enlighten yourself.

BENEFITS OF A SWP

A Systematic Withdrawal Plan (SWP) has many benefits, including:

EXIT SYSTEMATICALLY : You can make gradual redemptions while the rest of the corpus still produces market- linked returns. It takes away the pressure of timing the market perfectly. You can redeem gradually while the remaining corpus continues to generate market-linked returns, alleviating the pressure to perfectly time the market.

TAX EFFICIENCY : : Withdrawals are considered part-capital and part-return, so they are not fully taxed. You can also spread withdrawals over multiple years to stay in lower tax brackets. Withdrawals consist of both capital and return portions, which means they are not entirely subject to taxation. Additionally, you have the option to distribute withdrawals over several years to remain within lower tax brackets.

SWP can be tax-efficient for investors. There is no Tax Deducted at Source (TDS) applicable on SWPs. Capital gains arising in the context of SWP taxation may be eligible for indexation benefits, reducing the tax liability.

REGULAR INCOME : SWPs create a consistent income source by enabling you to take out a set amount at regular intervals. This can be advantageous for retirees or individuals looking for stable financial assistance.

FLEXIBILITY : You can choose the amount and frequency of withdrawals to suit your needs.

INVESTMENT CONTINUITY : The remaining funds in your investment portfolio remain invested, allowing you to continue benefiting from market returns.

DIVERSIFICATION: You can diversify your income sources, which can help spread risk and improve your overall portfolio performance.

RUPEE COST AVERAGING: The impact of volatility may be reduced.

REDUCED MARKET TIMING RISK:SWPs can help reduce market timing risk.

EFFECTIVE USES OF AN SWP

GENERATE SECONDARY INCOME : With rising living costs, an SWP allows you to invest in Mutual Funds and create a steady source of supplemental income or a secondary income.

ESTABLISH YOUR OWN PENSION : Even without a pension plan, you can build a corpus five years before retirement by investing in mutual funds based on your risk tolerance. After retirement, you can initiate an SWP to fund your pension.

SAFEGUARD YOUR CAPITAL : By choosing the dividend option and reinvesting in a debt scheme via SIP, you can eventually start an SWP for regular income while protecting your capital. Your financial expert can always do some handholding on this.

A very crucial feature of systematic withdrawals that needs to be elaborated here is Rupee Cost Averaging. When you buy or redeem units in instalments, you benefit from Rupee Cost Averaging. In volatile markets, timing your redemption is crucial for maximizing profits; selling during a slump can reduce gains. With a Systematic Withdrawal Plan (SWP), you regularly redeem units, meaning you'll redeem fewer units when markets are high and more when they're low. This averaging effect helps protect against losses during downturns. Here is an illustration for better understanding:

Geeta invested Rs.5 lakh in a mutual fund scheme in X yr. Let’s assume the NAV of the scheme was Rs.500 and she gets 1000 units. At the end of 5 months, she withdraws Rs.2.5 lakh from her investment. On the other hand, Mona invested the same amount in the same scheme and at the same NAV. However, she opted for an SWP of Rs.50000 every month, for 5 months. Here is what happens:

For example, the NAV of the scheme over the 5 months was as follows:

In September, when Geeta withdraws Rs.2.5 lakh from his investment, 502 units are redeemed (250000/498). Hence, she now has 498 units left and the value of her holdings is Rs.248004.

Now, let’s look at what happens to Mona’s holdings. Since she has opted for an SWP of Rs.50000 for 5 months, here is what she gets:

Hence, it is evident that Mona gains by opting for an SWP due to Rupee Cost Averaging.

Although many investments yield strong returns during a market upswing, if you've chosen a Systematic Withdrawal Plan (SWP) and your annual withdrawals are less than the returns earned from the scheme, your investment will sustain you far longer compared to a bear market. Additionally, by withdrawing the profits during bullish phases, you can secure those gains for yourself.

In a nutshell, just as a Systematic Investment Plan (SIP) teaches you a disciplined investment strategy, a Systematic Withdrawal Plan (SWP) helps you avoid the temptation to make large withdrawals out of panic during market corrections. With an SWP, you can feel confident that you won't overspend or take out excessive amounts from your savings.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts