TEN COMMANDMENTS OF A SUCCESSFUL INVESTOR

- Sun Nov 17 18:30:00 UTC 2024

- In Personal Finance by Malhar Majumder

On a cold winter evening, we debated the benefits of applying Artificial Intelligence (AI) in painting over a hot coffee. My friend, Dr. Surojit, states that you just need to describe your thoughts in words and ooh la la! the object appears right on your screen. Nandini added that the stuff you get is copyright free. Most professionals we know anticipate the possible disruption they will face from this mysterious AI. But the table turned when our friend Partha, a software engineer by profession and artist by heart, shared his perspective. AI doesn’t create an object from the air; it mixes and matches original art pieces stored in digital real estate and presents just another iteration. If creativity ceases, at some point in time, AI will also reach its saturation. The bottom line of the conversation is that the original idea can never be replaced with their spawns.

How does the above outcome affect someone deciding to put money in the markets? The famous American investor, Howard S. Marks, says, “ Investing is more Art than Science” . An AI may churn numbers with maximum proficiency and tell us the best place to invest, but will it be enough to nudge the investor to take the final decision? And again, if everyone makes the same decision: and buys the same product, does it help to achieve the intended result?

Ultimately, human preferences will always play a significant role in taking the final investment call. And if by some means, a decision is taken without considering the original need, it will get reversed sooner than later. This is why research in personal finance shows that returns on an asset are always more than the return achieved by an individual investor who has invested in the same asset.

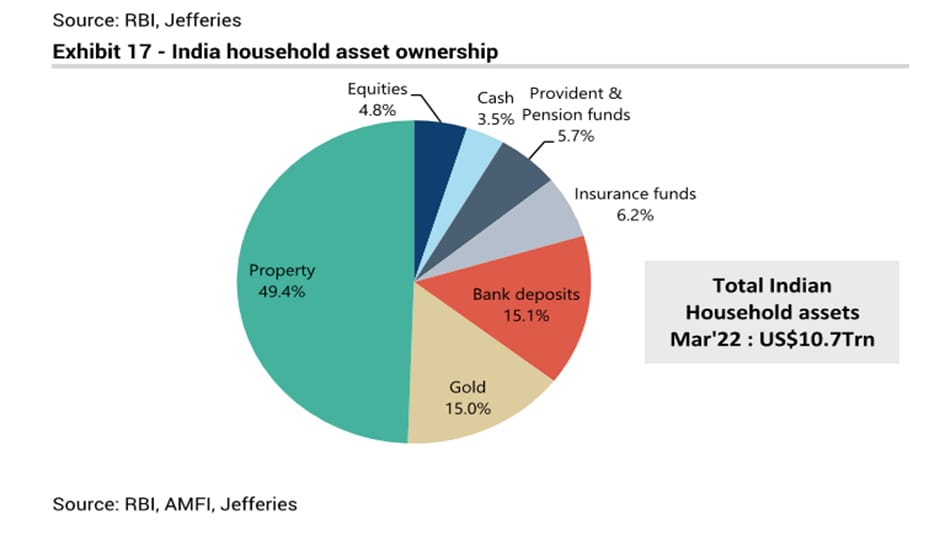

This brings us back to our theme, which is the originality of a successful investor. Does a successful investor chase a product that has historically given the maximum return? Or she chooses a product only when it helps her achieve her personal needs. You know the truth by now. And look at the data; though Indians relish discussing equities, they had invested only 4.8% of their overall financial assets in stocks. Clear proof that activity didn39;t bring in the action.

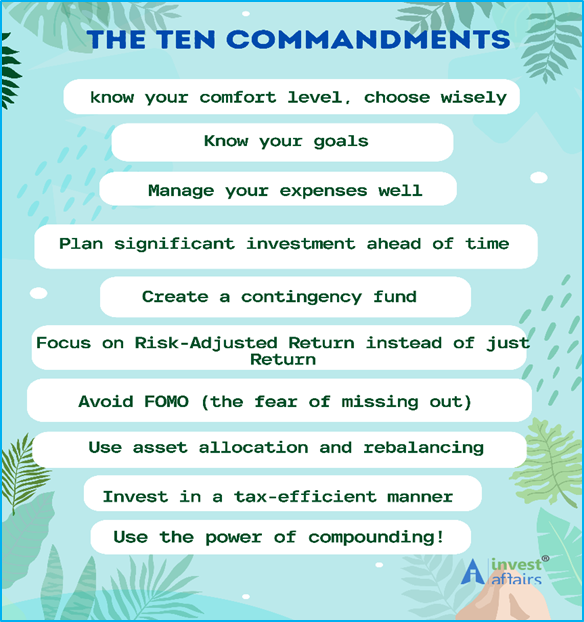

Personal investing is about asking a question to yourself about your comfort levels instead of asking the market how it shall behave in the future. If you have read up on this, you might be interested to know about the other nine commandments beyond originality that will make a successful investor. I will be obliged to make a list of them:

Each of these points has been deliberated on a lot in investment literature. Sometimes, I would like to return with my understanding of each of them. In the end, in the words of Poet Robert Frost, a successful investor will be someone who decides to travel alone.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts