CASE STUDY 1

Client Profile

Client: A young widow, Homemaker, Graduate

Situation:Unaware of spouse’s investments, responsible for a son and an ailing father-in-law.

When someone becomes a young widow suddenly and unexpectedly, it becomes very difficult to accept that one isn’t a ‘wife’ anymore. While this terrible life event is often experienced by people in their later years, many women experience this at a very young age. Everything seems very different, leaving them clueless and shattered. It is as if life suddenly threw a curve ball at you, and you find yourself in a sea of financial challenges. For many new widows this may be the very first time they have a large financial responsibility in the aftermath of losing a spouse. For the uninitiated, this may come across as a very daunting task if they had never participated in financial and investment decisions with their spouses.

This particular case study is about women who are unknowledgeable about the nitty-gritty of finance and investment and need professional help to organize their money and life in general. As we have often seen even the most independent, self-reliant woman who has a career, life, identity other than just being a wife or a mother, finds it very painful and distressing when struck with such a misfortune.

Grief is a great equalizer – It is never-ending. It never goes away, but yes, it becomes more manageable with time. One learns to move on, learns to evolve with it. The hardest part is the question- What next? Or how do I begin to pick up the shattered pieces of my life.

The most challenging thing about the financial stress surrounding the entire process is the guilt and embarrassment that it causes. It is very difficult to admit that you are not rich anymore (in some cases) and struggling to balance your daily finances with a decline in the household income by fifty percent or more. Furthermore, as a new widow, the challenges can exacerbate if your spouse was the primary earner or the sole earner who managed finances independently.

Historically, widowhood in India has been a harbinger of acute social discrimination and agony for several years. One of the main factors that becomes determinant in the quality of a widow’s life is finances. Needless to say, the absence of skills such as budgeting, investing, borrowing, taxation, and personal finances could be very detrimental for newly widowed individuals. If this is the case, then you will certainly need some handholding by a financial expert.

When a lady walked into our office, one fine morning, with similar trepidations we knew along with professional help she needed emotional and moral support as well. The very fact that she was in our office with all the documents she could organize after her husband’s sudden demise was a testimony to the fact that she trusted us. Whenever a ‘prospect’ or a ‘client’ visits our office, we know he/she is here just because of one thing, and that is TRUST. Trust is ‘the’ starting point in all our conversations revolving around personal finance and guidance offered by our experts.

The role of Investaffairs starts with listening to all the problems of the investor, listing them, instructing the operations and services team to guide our client in the process of procuring all the necessary documents. Most importantly, guide and help the client with all the technical aspects pertaining to mutual fund investments vis a vis KYC, notarization, attestations, transmission and other formalities. Our dedicated operations team is just a phone call away, always, to answer the queries.

We, at Investaffairs provide holistic support and guidance which is customized, and this case was no different. The steps followed in onboarding this client have been explained stepwise. Before we invite our clients for discussion, our experts do thorough research and proceed accordingly. Our approach in this particular case can be summed up as

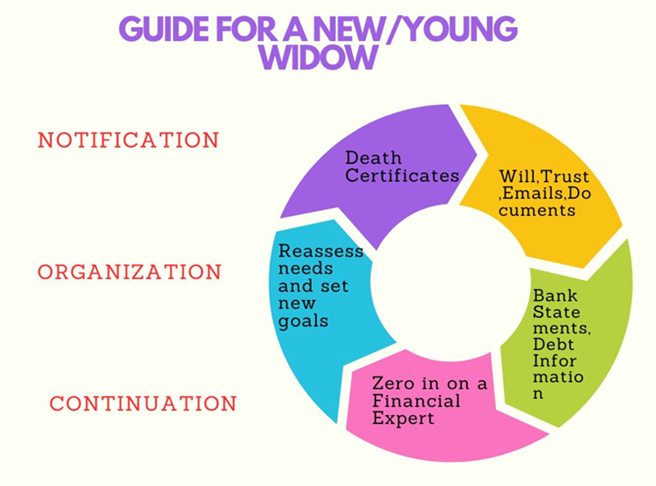

To acquaint our readers with what ‘new normal’ is, it is imperative that we explain the entire task in a much-detailed manner as we did for our client, before on boarding. This ‘New Normal’ is divided into three primary phases for the ease of understanding and operation:

NOTIFYING all the necessary people and relevant organizations about the death of your spouse. Our suggestion is, always get more death certificates than you think you might need.

GATHERING all the relevant documents. Find the will, life insurance policies and papers related to assets. Locate and write down the details and coordinates of all the assets.

Next, organize all the documents and statements chronologically. Most importantly, the bank statements and tax returns. Check your spouse’s emails for any important mail from his office or other institution. This process will lead you to listing and understanding what you have, what you may owe, the credit card dues (if any), any other loan and finally what you still need to sort out. This entire exercise will set the stage for the next step.

CONTINUATIONis how we would like to describe this final step before we set goals for our investor. As we have outlined previously, our client has a school-going son and an ageing father-in-law who is dependent on our client because of his age-related health issues. In this case a portfolio was created keeping in mind the lumpsum amount she had and a series of payouts that she would receive eventually from her husband’s office and his policies. There were a few investments in mutual funds as well of which she had no knowledge previously, so our operations team helped her with technicalities such as KYC, ARN transfer and Transmission.

Even if our client had been an income earner, our experts would have asked her to go through the drill of revisiting and reconsider her financial goals which would have also included retirement plans. With this investor our focus was to provide her with a simple yet concise plan to begin her life afresh. With no job, a privileged life suddenly snatched away, a young kid in tow and an aging parent to look after, she was like a boat without a sail when she came to us. Therefore, our aim was to create her portfolio, determine her monthly expenditures (by filling out and analyzing a proper data sheet) and immediate needs and start a *SWP at once. In this case, our client did not have any medical insurance. She did try to get one for herself and her child after her spouse’s demise but unfortunately that got rejected by the insurance company. We helped her in purchasing one albeit through a long and tedious process. This was followed by allocating her portfolio amount in various schemes. This entire process is humongous and involves huge paperwork and legalities. But with an organized and meticulous team like ours it was almost a cakewalk. It always is and our clients will vouch for that.

When we say our approach is holistic, we mean it. Over the course of time our clients become our extended families and we become not just their personal finance experts, but also their life planners to some extent. So whenever in doubt about financial planning, whenever you think, you are failing to manage your expenses, or faltering in striking a balance in your life, seek professional help. It lessens the emotional ramifications and brightens your life.

CONCLUSION: At Investaffairs, our commitment goes beyond financial planning. We aim to become a part of our clients' extended family, offering support in every aspect of their journey. When faced with financial uncertainties or life’s challenges, seeking professional help can make a significant difference, alleviating emotional burdens and providing clarity for the future. By following this comprehensive approach, Investaffairs ensures that clients receive the support and guidance needed to navigate through one of the most challenging phases of their lives. If you or someone you know needs assistance, do not hesitate to reach out for professional help.

SWP- Systematic Withdrawal Plan-Important features

- • It is a facility to redeem units regularly.

- • Investors can choose the frequency of withdrawals.

- • Investors can either withdraw a fixed amount or only the capital appreciation.

- • Ideal for those looking for regular income from their investments.

KEY WORDS: INVESTAFFAIRS, MUTUAL FUND GUIDE FOR WIDOWS, INVESTING FOR SINGLE MOTHERS, MUTUAL FUND BASICS, INVESTMENT STRATEGIES FOR WIDOWS, FINANCIAL ADVICE FOR WIDOWS WITH CHILDREN, MUTUAL FUND FOR FAMILY SECURITY, FINANCIAL LITERACY.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts