SIP VS ONE TIME INVESTMENT: Selecting the Ideal Strategy for Your Financial Goals

- Sun Sep 15 18:30:00 UTC 2024

- In Mentoring and Guidance by Aparna Bose

Navigating the world of investing can be intimidating, particularly for newcomers. One of the initial challenges you'll face is determining how to allocate your funds: should you choose a Systematic Investment Plan (SIP) or make a single lump sum investment? Each method has its advantages and disadvantages, and the best option will ultimately depend on your personal situation and financial objectives.

UNDERSTANDING THE TWO

SIP (Systematic Investment Plan): Allows you to invest a fixed amount of money at regular intervals, typically monthly, quarterly, or even weekly. This method is ideal for those who want to inculcate a habit of regular saving and investing. SIPs often have a low minimum investment threshold, making them accessible even to individuals with limited savings.

One-Time Investment (Lump Sum): This approach involves investing a larger sum of money all at once. This strategy might be suitable if you have received a bonus, inheritance, or simply saved a significant amount of money.

BENEFITS

SIP

Compounding : As your SIP contributions accumulate, they start earning returns on themselves (compounding). Over time, this compounding effect can significantly grow your wealth.

One-Time Investments

Potentially higher returns: If you invest a lump sum during a market downturn, you could potentially benefit from higher returns as the market recovers.

One-time investments require less ongoing management compared to SIPs.

A GUIDE TO HELP YOU DECIDE:

Choose SIPs if:

- You are a beginner investor.

- You have a long-term investment horizon (more than 5 years).

- You want to inculcate a habit of regular saving and investing.

- You are risk-averse and prefer a more balanced approach.

Choose One-Time Investments if:

- You have a large sum of money available for investment.

- You are comfortable with market timing and believe you can identify a good entry point.

- You have a shorter investment horizon (less than 5 years) and are comfortable with potentially higher volatility.

HYBRID APPROACH

You’re not limited to choosing between SIPs and one-time investments; you can effectively combine both strategies. For instance, if you receive a windfall, consider making a lump sum investment, then continue with regular SIP contributions.

Both SIPs and one-time investments have their merits, and the right choice depends on your unique circumstances and risk tolerance. By understanding the strengths and weaknesses of each method, you can make informed decisions that align with your financial goals. Consulting a financial advisor can also help you develop a personalized investment plan tailored to address your specific needs.

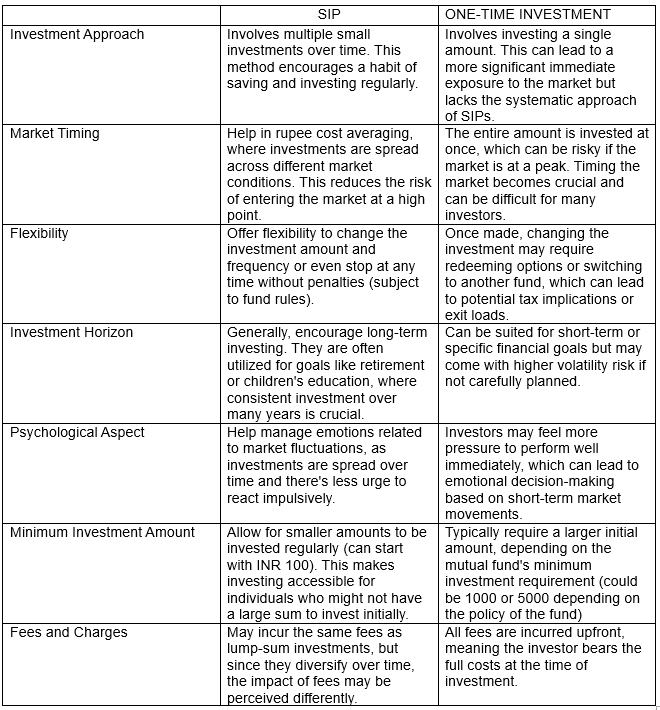

KEY DIFFERENCES:

CONCLUSION:

Both SIPs and one-time investments have unique advantages and drawbacks. SIPs encourage a disciplined and less risky approach to investing by leveraging the benefits of consistent, smaller contributions, while one-time investments can offer immediate exposure to the market but come with higher risks associated with timing and market conditions. The choice between the two depends on an investor’s financial goals, risk tolerance, and investment strategy.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts