The PAN (Permanent Account Number) card serves as a legal identity verification for various purposes, such as obtaining a gas connection and opening a bank account. It is essential for combating fraud and money laundering and is required for financial and legal transactions. In October 2023, Sebi had mandated all mutual fund investors to link their PAN with Aadhaar for KYC compliance by March 31, 2024. For opening any type of investment account like a Demat Account or a Mutual Fund Account, you need a PAN card. You cannot open a Demat Account without a PAN card. Thus, if you plan on investing in shares or mutual funds, you need a PAN card.

What is this PAN 2.0?

The PAN 2.0 Project is a comprehensive platform for managing PAN and TAN-related tasks, including applications, updates, Aadhaar linking, and online validation, all while promoting eco-friendly, paperless practices. It aims to position PAN as a universal identifier for government digital systems and aligns with the Digital India initiative. The project will enhance the 10-digit alphanumeric PAN (given by the Income Tax Department) by adding a QR code through an entirely online process, making it a reliable source of identification linked to Aadhaar for authorities. By consolidating and re-engineering these processes, the Income Tax Department has made a significant step towards establishing a seamless, transparent, and inclusive system for taxpayers.

Non-Resident Indians (NRIs) who need to file an income return or plan to engage in any economic or financial transaction that requires quoting PAN must obtain this identity proof.

This upgrade aims to improve the overall experience for taxpayers by providing quicker service delivery, efficient grievance resolution, and enhanced protection of sensitive information. The project will simplify the process for users to apply for PAN/TAN online, update their details, and validate PAN information electronically.

FREQUENTLY ASKED QUESTIONS (FAQS) ON PAN 2.0 PROJECT

1. What is PAN 2.0?

PAN 2.0 Project is an e-Governance project for re-engineering the business processes of taxpayer registration services through technology-driven transformation of PAN/TAN services for enhanced digital experience of the taxpayers.

PAN 2.0 Project is an e-Governance project of ITD for re-engineering the business processes of taxpayer registration services. The objective of the project is to enhance the quality of PAN services through adoption of latest technology. Under this project ITD is consolidating all processes related to PAN allotment/updation and corrections. The TAN-related services are also merged with this project. Besides, PAN authentication/validation through online PAN validation service will be provided to user agencies such as financial institutions, banks, government agencies, central and state government departments etc.

As per an official release- "This will be an upgrade of the current PAN/TAN 1.0 eco-system consolidating the core and non-core PAN/TAN activities as well as PAN validation service."

2. What are the benefits associated with PAN 2.0?

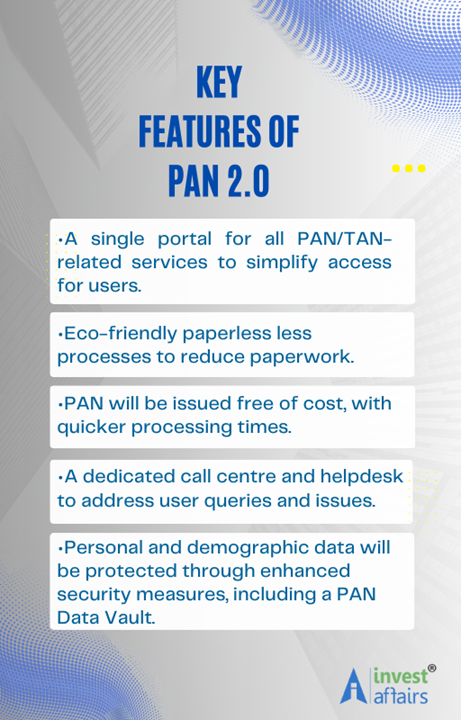

Applications and updates will be handled more efficiently, reducing wait times.

A centralized database ensures uniformity and helps avoid mistakes in taxpayer information.

Existing PAN holders can upgrade their cards at no cost.

Digital processes eliminate the need for paperwork, supporting sustainability efforts.

The platform safeguards essential taxpayer data using dependable technologies.

3. How PAN 2.0 will be different from existing setup?

- The primary benefit of PAN 2.0 will be “Integration of Platforms”. Presently, the PAN related services are hosted on three different portals - e-Filing Portal, UTIITSL Portal and Protean e-Gov Portal. In the PAN 2.0 Project, all PAN/TAN related services will be hosted on a single unified portal of ITD. The said Portal would host all end-to-end services related to PAN and TAN like allotment, updation, correction, Online PAN Validation (OPV), Know your AO, AADHAAR-PAN linking, verify your PAN, request for e-PAN, request for re-print of PAN card etc.

- PAN 2.0 initiative is going to be a complete online paperless process as against prevailing mode.

- Taxpayer facilitation: Allotment/updation/correction of PAN will be done free of cost and e-PAN will be sent to the registered mail id. For physical PAN card, the applicant has to make a request along with the prescribed fee of Rs 50 (domestic). For delivery of card outside India, Rs. 15 + India post charges at actuals will be charged to the applicant

4. Whether existing PAN CARD Holders will be required to apply for new PAN under the upgraded system?

No. The existing PAN card holders are not required to apply for new PAN under the upgraded system (PAN 2.0).

5. Do people have an option to get corrections done on PAN, like name, spellings, address change etc?

Yes, absolutely. Existing PAN holders wishing to correct or update their PAN details—such as email, mobile number, address, or demographic information like name and date of birth—can do so at no cost once the PAN 2.0 Project is launched. Until the PAN 2.0 Project is implemented, PAN holders can utilize the Aadhaar-based online service to update or correct their email, mobile number, and address for free by visiting the URLs provided below:

https://www.onlineservices.nsdl.com/paam/endUserAddressUpdate.html

https://www.pan.utiitsl.com/PAN_ONLINE/homeaddresschange

In any other cases of updation/correction of PAN details, the holders can do so using the existing process either by visiting physical centres or applying online on payment basis.

6. Do I need to change my PAN card under PAN 2.0?

No. The PAN card will not be changed unless the PAN holders want any updation/correction. The existing valid PAN cards will continue to be valid under PAN 2.0.

7. Many individuals have not updated their addresses and are still using their previous ones. How will the new PAN be sent to them?

No new PAN card will be delivered unless the PAN holder requests for it owing to any updation/correction in their existing PAN. The PAN holders who want to update old address, they can do so free of cost using Aadhaar based online facility by visiting the below URLs:

https://www.pan.utiitsl.com/PAN_ONLINE/homeaddresschange

https://www.onlineservices.nsdl.com/paam/endUserAddressUpdate.html

Accordingly, the address will be updated in the PAN database.

8. If new PAN cards are QR code enabled, will older ones continue to function as they are?

The QR code is not a novel addition, having been included in PAN cards since 2017-18. This feature will continue in the PAN 2.0 project, with improvements such as a dynamic QR code that displays the most current information from the PAN database. Holders of older PAN cards lacking a QR code can apply for a new card with a QR code through both the existing PAN 1.0 system and the PAN 2.0 initiative.

9. What will QR code help us with?

The QR code helps in validating the PAN and PAN details.

Presently, a specific QR reader application is available for verification of QR code details. On reading through the reader application, complete details, i.e., photo, signature, Name, Father’s Name / Mother’s Name and Date of Birth is displayed.

10. What is - the "Common Business identifier for all business-related activities in specified sectors"?

In the Union Budget 2023, it was announced that for the business establishments required to have a PAN, the PAN will be used as the common identifier for all digital systems of specified government agencies.

11. Whether Common Business identifier will replace the existing unique taxpayer identification number i.e. PAN?

No. PAN itself will be used as a Common Business identifier.

12. What does the “Unified Portal” mean?

Presently, the PAN related services are hosted on three different portals. In the PAN 2.0 Project, all PAN/TAN related services will be hosted on a single unified portal of ITD. The said Portal would host all end-to-end services related to PAN and TAN like allotment, updation, correction, Online PAN Validation (OPV), Know your AO, AADHAAR-PAN linking, verify your PAN, request for e-PAN, request for re-print of PAN card etc., thereby further simplifying the processes, and avoiding delay in PAN services delivery, delay in redressal of grievances etc. caused by the presence of various modes of receipt of applications (online e KYC/online paper mode/offline).

13. How can an NRI apply for PAN?

An NRI can apply for PAN by submitting the Form No. 49A along with the requisite documents and prescribed fees at the PAN application center of UTIITSL or Protean (formerly NSDL eGov). He can also make an online application through the website of UTIITSL or Protean (formerly NSDL eGov).

14. For people holding more than one pan, how will you identify and weed out the extra PAN?

As per the provisions of Income-tax Act, 1961, no person can hold more than one PAN. In case a person holds more than one PAN, he/she is obliged to bring it to notice of Jurisdictional Assessing officer and get the additional PAN deleted/de-activated.

In the PAN 2.0, with the improved systems logic for identification of potential duplicate requests for PAN and centralized and enhanced mechanism for resolving the duplicates would minimize the instances of one person holding more than one PAN.

15. What are the Types of PAN Cards in India?

PAN cards can be issued for any entity that is liable to pay taxes, for example, individuals, HUFs, NRIs, companies and institutions. The applicant status is represented by the 4th digit on the PAN number, which is different for each type of PAN card.

The following are all the different types of PAN cards and their letters:

P: For individuals

B: For Body of Individuals (BOI)

A: For Association of Persons (AOP)

H: For Hindu Undivided Family (HUF)

C: For companies

E: For Limited Liability Partnership

F: For partnership firms

T: For trusts

G: For government agencies

L: For local authority

J: For artificial judicial person

Let us take the example of a PAN- BHPCA5845D to know what type of PAN card it is.

The first three numbers are in a sequence from AAA to ZZZ, while the fourth character, C, tells us that it is a PAN for a company. Next, the fifth character A represents the first character of the company’s name. The four numbers after that are in a series from 0001 to 9999, while the last letter is an alphabetic digit check.

16. Do we need to link my Aadhaar with PAN?

Yes, it is compulsory for individuals to link their Aadhaar with PAN. If they fail to link both these documents, they won’t be able to file income tax returns. Moreover, they will not be able to carry out a banking transaction worth over Rs. 50,000.

17. Who is Eligible for PAN 2.0?

All current PAN cardholders are automatically qualified for the PAN 2.0 upgrade. If you already possess a PAN, there’s no need to submit a new application; you can simply request the updated QR-enabled version. New applicants must fulfill the standard eligibility requirements by providing valid proof of identity and address. PAN 2.0 will be offered free of cost to all taxpayers.

18. How to Apply for PAN 2.0 Online?

The application process for PAN 2.0 is designed to be user-friendly and entirely online.

Here’s a step-by-step guide:

- Visit the Unified Portal: Once launched, the dedicated portal will handle all applications.

- Enter Personal Details: Fill in the required fields with your personal information.

- Upload Necessary Documents: Submit scanned copies of identity, address, and date-of-birth proofs.

- Submit the Application: Review the details and submit the form securely

Documents Required for PAN 2.0

Applicants must provide specific documents for verification:

- Proof of Identity: Aadhaar card, Voter ID, Passport, or Driving License.

- Proof of Address: Utility bills, bank statements, or rent agreements.

- Proof of Date of Birth: Birth certificate, school leaving certificate, or passport.

Ensure these documents are accurate and up to date to avoid delays in the process.

We have made every effort to ensure that the article on PAN 2.0 is as comprehensive as possible. Our objective was to provide a thorough exploration of the topic, covering all relevant aspects and addressing potential queries that our clients in particular and readers in general may have.

Your feedback is invaluable to us, and if there are any areas where you feel we could improve or add any information, we would love to hear your thoughts.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts