An Alternative to Your Rainy Day Fund

Life can be quite unpredictable, and it's not uncommon to face temporary financial challenges due to various circumstances—such as a home renovation, a vacation you can’t miss, a family wedding, or a medical emergency. In these cash-strapped moments, you might first think of dipping into your savings or liquidating your investments, often at a loss. If those options fall short, seeking a loan may seem like the straightforward next step. Loans can help when unexpected expenses arise, providing immediate relief and peace of mind during tough times.

However, there’s a more strategic approach IF you have invested in “Mutual Funds”. Remember the advertisement (an investor education initiative powered by AMFI), where Sachin Tendulkar and Dhoni speak about MF and SIPs in MF being ‘sahi’ (correct) ! Now the mutual fund investors have one more reason to park their hard earned money in the mutual fund schemes as they can help them tide over any crisis without selling the units. Instead of selling your precious mutual fund investments, you may now leverage them for a loan. Just as you can use assets like gold or real estate as collateral, banks and Non-Banking Financial Companies (NBFCs) offer loans against your mutual fund holdings. This way, you can access funds without compromising your long-term investments.

You have mostly come across borrowing loans against land, gold, or a house. But, if you’ve put your money in a mutual fund investment, can you take a loan against it?

Let’s find out.

An overdraft against mutual funds, could it be? Emergencies, whether small or large, can arise unexpectedly and create short-term financial challenges. While investment funds are generally considered liquid, not all funds offer the same level of accessibility. In some cases, redeeming your investments might disrupt your financial goals, making liquidation an unappealing option. It's essential to have a strategy in place to address potential short-term cash needs without jeopardizing your long-term objective.

So, a loan against mutual funds could be an opportunity to keep the fund and still be supplied with the finance, right?

Who is eligible for availing Loan Against Mutual Fund ?

Investors who are between the ages of 18 and 60 are eligible for loans against their mutual fund investments.

How to Take Loan Against Mutual Fund ?

You can avail of loans to only a “Certain Limit” of your Mutual Fund Holding The amount of loan you may acquire against your mutual funds holdings is primarily determined by the sort of mutual fund scheme in which you have invested and the financial institution from which you will borrow.

The Loan You Can Get Has an Upper Limit loan against mutual funds, like any other form of loan, have specific restrictions. Many banks have a maximum and minimum loan amount that you can get.

You won’t Get these Loans From All the Banks. Many banks only lend money against a certain set of mutual fund plans that they have chosen.

It will Cost you Less for a Loan Against Mutual Funds than Personal Loans or Credit Cards

A significant advantage of a loan against mutual funds is that the interest rate is lower than that of credit cards or personal loans.

The reason being: loans against mutual funds are secured, that is, they are guaranteed by collateral.

What are the Advantages of Taking a Loan Against Mutual Funds?

You Get a Lower Interest Rate

Loans against mutual funds often have lower interest rates than personal loans. Because it is a secured loan, the interest rate is lower than that of unsecured loans.

You Do Not Need to Redeem your Mutual Fund

Investors are not required to redeem the MF plan in order to get loans against it. The units are pledged as security for loans but are not sold, allowing investors to get loans while maintaining ownership. In fact, if money is tight, it is best not to sell the apartments and instead take out a loan against them.

Quick Money

It is useful when there is a need for rapid cash. In times of financial crisis, one can pledge fund units even online and get money into an account. Because you are already an investor, the loan application process is simplified, with minimal documentation and eligibility requirements.

A Source of Short-Term Capital Needs

Loans against MF might be beneficial when money is needed for short-term purposes. You can raise cash from investment fund units for a short period of time and repay it gradually without jeopardizing scheme ownership.

Pay Interest for the Used Loan Amount

Interest is not to be paid on the full loan amount promised from the investment plan but only on the amount actually utilized, that is, the amount credited or overdraft from the current account.

When you want to continue your mutual funds without a hitch but the problem is you need liquid money, a loan against mutual funds interest rate, a loan against SIP, or an overdraft can come in handy. This is one of the most prominent benefits of the option of availing of a loan against your mutual fund.

How does a loan against a mutual fund work?

A Loan Against Mutual Funds is a secured loan where borrowers pledge their mutual fund units as collateral to secure a loan from banks or Non-Banking Financial Companies (NBFCs). This serves as a convenient short-term credit solution that caters to urgent financial needs without liquidating mutual fund investments.

What is the processing fee for mutual fund loan?

There is a processing fee of up to 4.72% of the loan amount (inclusive of applicable taxes), when applying for a loan against mutual funds. This fee covers the costs associated with processing your loan application.

Fees and charges associated with loans against mutual funds

- Interest rate: the lender may charge interest on the loan amount, which can vary depending upon the loan amount, repayment period and other factors.

- Processing fee or Origination fee: the lender may charge a processing fee for the loan, which is usually a percentage of the loan amount.

- Part-prepayment penalty: some lenders may charge a part- prepayment penalty if you choose to repay the loan before the end of the loan term.

- Late payment fee: if you miss a loan repayment, the lender may charge a late payment fee

- Stamp duty: in some cases, stamp duty may be charged on the loan agreement.

It’s important to read the loan agreement carefully and understand the fees and charges associated with the loan before applying for it.

Foreclosure charges associated with loan against mutual funds

There is full prepayment charge up to 4.72% (inclusive of applicable taxes) on the outstanding loan amount as on the date of full prepayment and there is part-prepayment charge up to 4.72% (inclusive of applicable taxes) of the principal amount of loan prepaid on the date of such part- prepayment.

How does one calculate interest on loan against mutual funds?

Interest may vary from lender to lender. For example, Bajaj Finance offers loan against mutual funds at an interest rate of up to 20 % per annum.

What is the loan to value for mutual funds finance?

LTV ratio for a loan against mutual funds with Bajaj Finance is up to 90%. However, the actual LTV ratio may vary depending on the lender and the specific terms and conditions of the loan.

How much loan can be availed?

You Can Get a Loan Only Up to a Limit of Your Mutual Fund Holdings. The amount of loan you can get against your mutual fund holdings largely depends on the type of mutual fund scheme you have invested in and the financial institution from which you will borrow.

For instance, banks like HDFC and ICICI give you a loan of up to 50% of the Net Asset Value (NAV) in the case of equity mutual funds and up to 80% in the case of debt mutual funds. Axis Bank, on the other hand, provides a loan of up to 85% of the value of your debt mutual fund schemes and 60% of the value of your equity mutual fund scheme.

Do all banks give Loan Against All Mutual Funds?

Many banks lend money only against a set of mutual fund schemes selected by them. For instance, SBI only gives loans against mutual schemes of SBI Mutual Funds. HDFC Bank and ICICI Bank are also selective about the schemes against which they lend money. Both these private banks offer loans on mutual fund schemes managed by asset management companies registered with CAMS ( Computer Age Management Solutions Private Limited ). Similarly, Axis Bank has listed a set of mutual fund schemes on its website against which it lends money.

Is There A Upper Limit on the Loan Amount You Can Get?

Like any type of loan, there are certain limits in loans against mutual funds as well. Many banks have a maximum and minimum limit on the amount of loan you can get.

For instance, most big private banks like ICICI Bank have set the minimum loan amount at Rs. 50,000 and the maximum amount at Rs. 20 lakh in case of equity mutual funds and up to Rs. 1 crore in case of debt mutual funds.

In the case of NBFCs, both the minimum and maximum limits are usually higher. For instance, the minimum loan amount at Aditya Birla Finance is Rs 25 lakh and the maximum is Rs. 10 crore. Similar is the case with Bajaj FinServ as well.

What Is The Key Benefit Of Loans Against Mutual Funds?

A key advantage of a loan against mutual funds is the lower interest rate compared to credit card or personal loans. These loans are secured, meaning they are backed by collateral, which reduces the lender's risk. Typically, the interest rate for loans against mutual funds ranges from 8-10%, depending on the bank and the specific mutual fund schemes. Generally, pledging units of debt fund schemes results in a lower interest rate, while equity fund units may attract a higher rate.

In contrast, unsecured loans, such as credit card or personal loans, are not backed by any collateral. As a result, lenders charge higher interest rates, often exceeding 10%, to compensate for the increased risk

Do You Earn Returns On Your Pledged Mutual Fund Units?

By pledging your mutual fund units as collateral for a loan, you can access funds while keeping your investments actively engaged in the market. You continue to earn returns. The bank gains the right to sell these units only if you default on the loan. As long as you stay on track with your repayments, your investments continue to generate returns, preserving your financial strategy. This approach allows you to quickly secure the capital you need without having to redeem any units, ensuring your financial plan remains intact.

Can We Apply Online?

Thanks to technology, many banks like SBI, HDFC, ICICI, etc are now giving a loan against your mutual fund holdings online. All you need to do is pledge your mutual fund units online and get an overdraft limit set in your account.

Overdraft facility means a credit agreement with your bank that allows you to withdraw more money than what you have in your account. It has a pre-approved limit. For example, if the overdraft limit is Rs. 2 lakh and you have Rs. 50,000 in your bank account, then you can withdraw up to Rs. 2.5 lakh from that account. For availing of this overdraft facility, the bank will charge you interest.

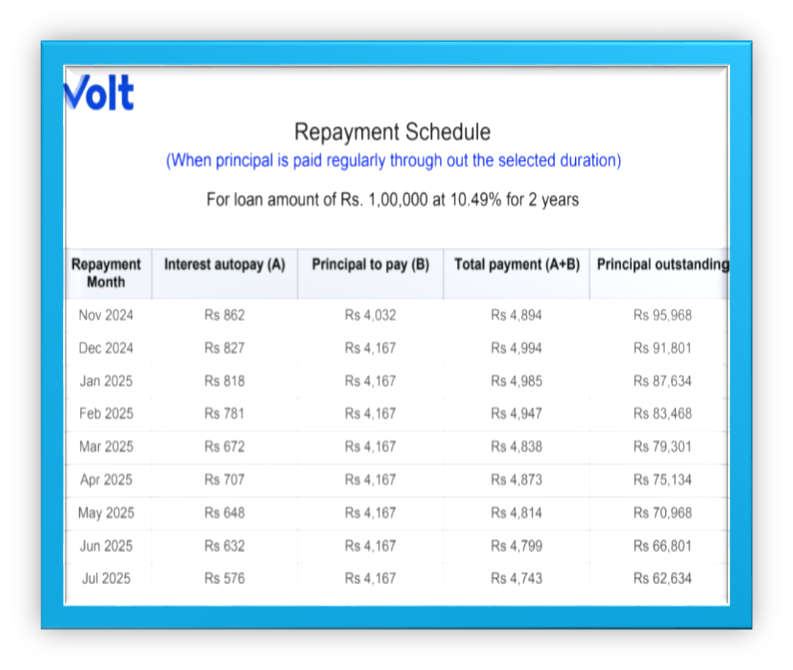

Here’s an example to help clarify the entire process:

As this entire depiction is based on our Client’s requirement, we have provided a computation while ensuring the name remains confidential... However, the intermediary and the lender mentioned here are real and so is the loan amount requested by the client. We will continually update the article as we conduct transactions related to loans against mutual funds.

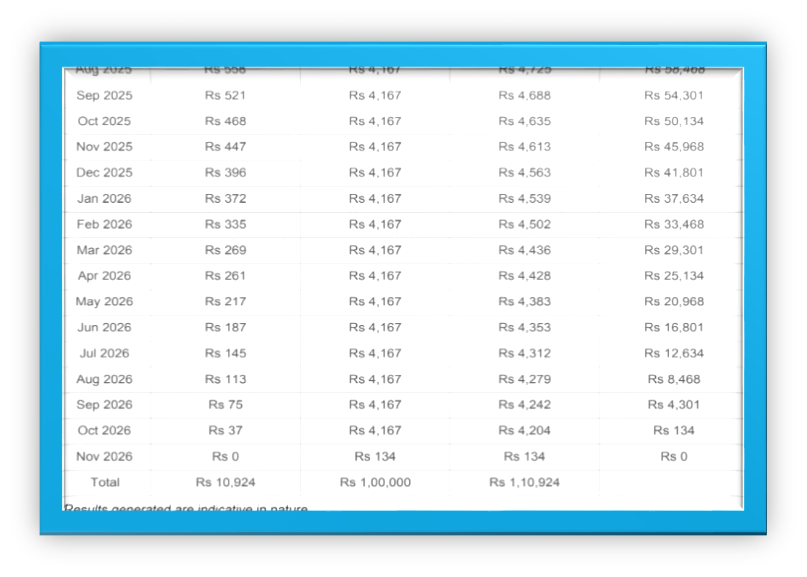

A RECENT COMPUTATION OF LOAN AGAINST MUTUAL FUNDS AT INVESTAFFAIRS

LENDER- BAJAJ FINSERVE

LOAN AMOUNT- INR 1,00,000

LOAN THAT CAN BE AVAILED- INR 98,231

PROCESSING FEES- INR1499+18 PERCENT GST= INR1769

INTEREST RATE- 10.49% PER ANNUM

INTERMEDIARY- VOLT MONEY

PROCEDURE-

- A profile is created (online)

- The lender will take the borrower through an online KYC

- Once KYC gets validated, the borrower may place a request for the required amount

- Loan amount gets parked with the intermediary in a wallet

- Withdrawal and repay options are explained with clarity

- Incase of any confusion the borrower can easily access the "help" option

- Entire procedure is online and based on OTP generation.

- For clients not well versed with the process, the operations team of the distributor works in tandem for the same. At Investaffairs we take utmost care in such cases for our esteemed clients.

- This is a usually a hassle-free process

Tables Showing Interest Charged Per Month

CREDIT RISK:

Shortfall occurs when credit limit drops below the outstanding amount. Credit limit may drop due to fall in market value of pledged portfolio.

You may address this shortfall by:

- Repaying the shortfall amount You can repay the intermediary using UPI, net banking, or debit card

- Pledging additional fund0073

You may avoid the shortfall by:

- Utilizing upto 95% of your total credit limit (advisable) This will ensure that a shortfall will occur only when your portfolio value decreases by 5%.

- In case of more than 95% utilisation, it is recommended to make a partial repayment if your portfolio value decreases due to market fluctuations.

What happens if a borrower fails to meet the shortfall?

If a borrower fails to address the shortfall within 7 days from the date it occurred, Part of hi/her portfolio will be sold off to recover the shortfall amount.

CONCLUSION

When there is a failing market, it is better to take a loan instead of redeeming the units at a loss or so. You can take a loan, which can prove to be more beneficial. When you do this, you have not liquidated your fund, and when the market does better, the price of your share will rise up again. In a bull market where all funds are profitable, it is preferable to sell the units rather than borrow. If you are in a bull period, redeem. Borrow during a down market. If you require money quickly, be sure you borrow sensibly.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts