GENZ HARNESSING THE 3 IDIOTS : FEAR, DOUBT, INDOLENCE

- Sun Jun 30 18:30:00 UTC 2024

- In Case Studies by Aparna Bose

CASE STUDY 3

Client Profile

Client: Young investor, in 20s or early 30s, young professionals, young self-employed

Situation: Want to set investment goals, eager to learn and financially educate themselves, ready to modify lifestyle.

How young is too young in the context of investing? One would be fairly astonished to see the number of young and dynamic go-getters adorning our clientele. Out of them some are minors who have been initiated into the discipline of investment by their parents and / or guardians. But the lot, that is young, earning and mostly on their own, starting young is a bit challenging as they do not have enough money. Is that a deterrent then? Not with these 20 and 30 something.

Overthinking about an appropriate and favourable time or opportunity will only add to your stress and delay. When a young person with big dreams and goals comes to us to create a portfolio, it is not going to be an exaggeration if we tell you that we feel extremely honoured and happy to be doing that. The young people who have just about started earning and are not that worldly-wise always find it challenging to trust others. So, when they entrust us with their money it is a defining moment for us.

How do we guide them?

We always tell them it is wise to start investing in smaller amounts. They must give time to their money to mature. The number one regret for many people is not saving early enough for retirement. That is why we suggest that you talk with a wealth manager/ financial professional who can help you adjust goals and strategies to your specific lifestyle.

In Warren Buffett’s words- “Achieving success in investing requires three key attributes: Time, Discipline, and Patience”.

Ideally one should start saving a portion of their income from the moment they start earning. There is a process called Auto Debit Mandate or standard instructions by which a certain amount is taken out of your paycheck or salary account every month on a stipulated basis. For example, as in SIPs, automating your SIPs will ensure you are investing towards your goals in a disciplined manner as the process will happen on its own periodically. You will learn to live on a smaller net amount as your savings continue to grow. The mantra is ‘What you cannot see, you cannot spend’.

While allocating funds towards various goals we encourage our clients to make adjustments in their lifestyle to help save money. Our financial experts spend a lot of time with the clients before their onboarding to understand their psyche and the risk they are ready to take with their investments. These are very technical aspects, so more on this in future posts. Setting clear investment goals is a vital aspect of financial planning for young professionals and self-employed individuals. Whether the goal is to save for retirement, purchase a home, or start a business, having specific and measurable objectives can help individuals stay focused and motivated. By outlining short-term and long-term investment goals, young professionals can create a roadmap for their financial future.

This may sound simple and very easy, but it is a real challenge to save and invest at a young age. To begin with one must repay debts (credit cards mainly), reduce or cut down on discretionary expenses like expensive coffee, dining out every weekend at costly restaurants, smoking, shopping for branded clothes etc. Once you have destroyed your debt, your personal finance can accommodate a certain amount towards retirement savings. Even something as simple as packing your lunch or eating within your budget can have a huge long-term impact on your budgeting strategy. Saving 100 to 150 rupees per day can mean a lot. How and why? Again, that is something our experts can explain if you really want to educate yourself on this. Please do drop by and spend some time at our office over a cup of chai or coffee.

However, to substantiate the importance of starting with a smaller amount to achieve your dreams when young, it is important for you to understand the *“Power of Compounding”. In simple terms it means the longer the period of investment, the more it grows, in other words the longer your money has to grow or compound. Our experts will assess the risks you are ready to take, align them with your goals, allocate funds accordingly and assess the cash flow as well. Once you create your portfolio at Investaffairs, you can do a periodical review of your portfolio with your RM and get to understand the nuances of personal finance. This will help you to develop a habit of saving more. We have already elaborated on financial tactics one needs to incorporate in their life in their 60s and beyond in other blog posts. Since we are talking about the benefits of “starting young”, we would like to highlight a few strategies that encompasses this journey of gathering and protecting wealth.

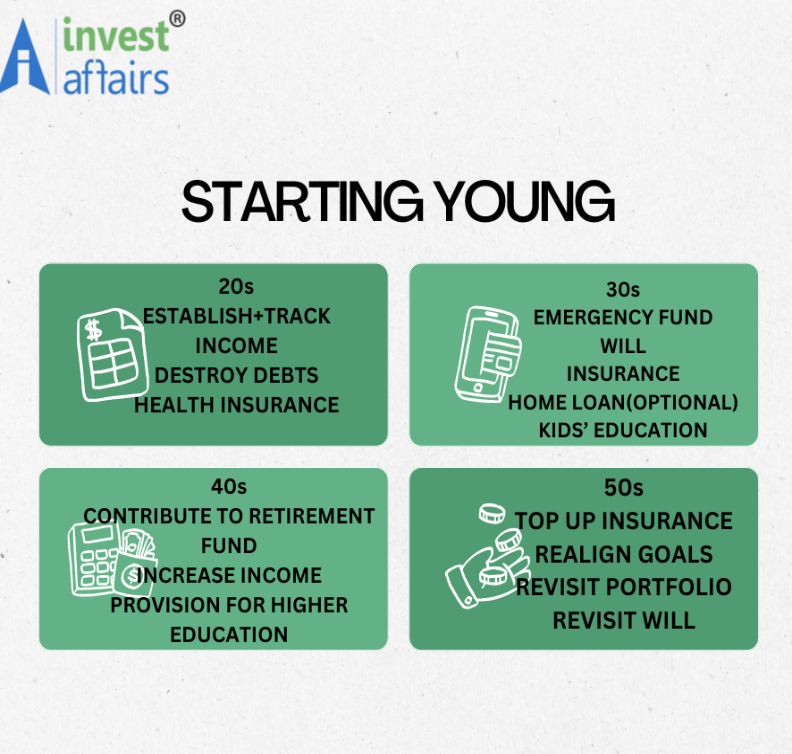

IN YOUR 20s:

- Establish your income

- Track the money you have against your monthly expenditure.

- Destroy debts

- Buy health insurance.

- Seek professional help to manage your ‘personal finance’.

IN YOUR 30s:

- Plan and build your emergency fund (equivalent to 3 to 6 months’ salary).

- Create a will.

- Get life insurance and a home loan (if required).

- Start saving for kids’ education (as and where applicable).

IN YOUR 40s:

- Maximize contribution to retirement fund (starting early will take care of this).

- Increase your income. (If raises and promotions are not good then switch jobs).

- Map out college payment options.

IN YOUR 50s:

- Top up your health insurance.

- Realign your portfolio. Revisit your goals.

- Revisit or create your will (important as you may have accumulated more/new wealth).

- Add or change nominees.

If you have read this far, you must have realized one thing that starting early sets a stage for a lifetime of financial security and comfort. It can make a difference between a relaxed retirement and financial struggle in the twilight of your life.

Furthermore, it is imperative that we mention one vice that the younger generation falls prey to as they are the most vulnerable at this age. The nasty trap of lending and/or borrowing. We always advise our clients, across all age groups, to neither borrow money nor lend money. As Shakespeare wrote- “Neither a borrower nor a lender be” (Act 1, Scene 3 of Hamlet).

Sometimes you may be genuinely concerned about a person and help them monetarily. In such cases consider it a gift and don’t expect it back. But an effort should be to never borrow money from friends nor lend money out ever. You might never be able to retrieve and end up losing friends. It is mostly the friends and relatives who swindle you out of your money. As it is, you do not lend money to strangers. So, to conclude this post we would like to request all our readers to get back to us with their thoughts on this and send us their queries.

*Power of compounding in case of mutual fund investments can be one of the most efficient methods of asset creation. The compounding effect increases with the increase in your investment capacity. Hence, for the same goal, if you start investing earlier, you are more likely to reap relatively better benefits. Let’s say you invested Rs 100, Rs 5 interest on this investment. Now, in the next compounding cycle, the return will be calculated on Rs 105 instead of Rs 100. Hence, with compounding, your corpus grows exponentially rather than linearly.

Ideally, you should not redeem your mutual fund investments unless you have reached your financial goal for which you had mapped your investment. Starting afresh will mean losing out on the benefits of compounding. The more you invest and the earlier you start, the greater the compounding effect will be. It is advisable not to redeem your mutual fund investments prematurely, as this would mean missing out on the long-term benefits of compounding.

Mathematically, the formula to calculate the compound interest is as below -

A= P(1+r/n) ^ (nt)

Where A= value of the investment in the future

P= value of the investment in the beginning/ principal amount

r= rate of interest

n= number of times your capital gets compounded in a particular period, say, a year

t= number of such periods, say, number of years for which the money is invested for.

CONCLUSION: Young professionals and self-employed individuals have a unique opportunity to take control of their financial future by setting investment goals, seeking financial education, and making lifestyle adjustments. Modifying one's lifestyle is often necessary to achieve investment goals. This may involve cutting back on unnecessary expenses, increasing savings contributions, or finding additional sources of income. By making conscious choices that align with their financial objectives, young professionals and self-employed individuals can accelerate their progress towards financial independence. By prioritizing financial literacy and planning for the long term, individuals in this demographic can build a solid foundation for a secure and prosperous future.

#INVESTAFFAIRS #YOUNGPROFESSIONALS #INVESTING #FIANCIALEDUCATION #INVESTMENTGOALS #LIFESTYLEMODIFICATION #SMARTFINANCIALHABITS #RETIREMENT SAVINGS #SHORTTERMGOALS #LONGTERMGOALS

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts