STEP TOWARDS EMPOWERING THE EMPLOYEES

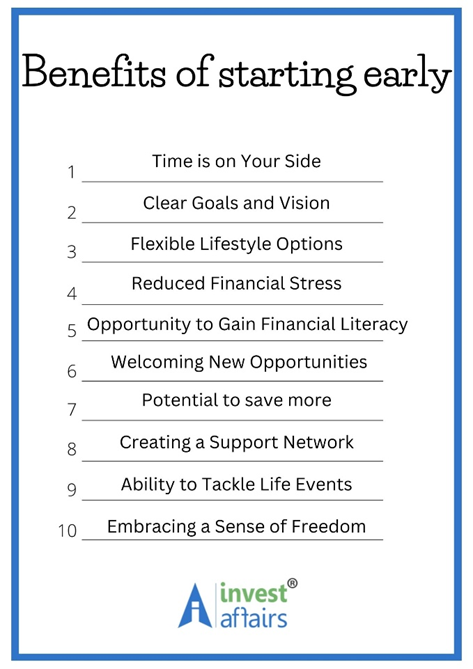

Planning for retirement early can transform what is often perceived as a daunting and difficult process into a manageable and even exciting journey. Starting retirement planning early offers a multitude of benefits that extend well beyond mere financial readiness. By taking advantage of the time available, individuals can harness the power of compound interest, enabling even modest contributions to grow significantly over time. The flexibility afforded through early planning allows for an exploration of diverse lifestyle options during retirement, ultimately contributing to a richer life experience.

We have written and uploaded several articles and case studies on this subject as planning and saving for the sunset years forms the crux of investment. Moreso, because early retirement planning can alleviate stress and lead to a more secure future. As Mutual Funds distributor this is our utmost objective- "The Financial and Physical well-being of our clients"

Moreover, the peace of mind that comes from reduced financial stress, enhanced financial literacy, and the ability to adapt to changing circumstances cannot be overlooked.

In this article we will discuss the benefits of contributing and saving by means of EPF:

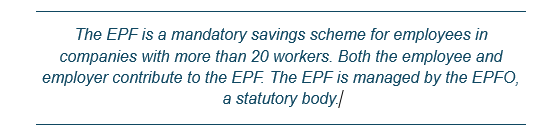

The Employees Provident Fund (EPF) is a retirement savings scheme that is available to all salaried employees in India. The scheme is administered by the Employees' Provident Fund Organization (EPFO), which is a statutory body under the Ministry of Labour and Employment, Government of India.

Difference with other provident funds

Other provident funds, like the Public Provident Fund (PPF) for all Indian citizens and the General Provident Fund (GPF) for government employees, are optional savings schemes. The EPF scheme, launched in 1952, aims to enhance social security and provide a secure future for millions of employees in recognition of their contributions to organizations.

More about EPFO

The EPFO is an organization that assists the CBT (Central Board of Trustees) and has offices in 122 locations across India. The EPFO is under the administrative control of the Ministry of Labour and Employment, Government of India.

The EPFO administers a contributory provident fund, pension scheme, and an insurance scheme for the workforce in India's organized sector.

The members of the Employees' Provident Fund Organization (EPFO) include :

- A Chairman

- A Vice-Chairman

- 5 Central Government Representatives

- 15 State Government Representatives

- 10 Employees' Representatives

- 10 Employers' Representatives

- The Central Provident Fund Commissioner

- The Member Secretary

What is the importance of employee provident fund?

In the long run, contributions to the employee provident fund help build a strong retirement corpus, providing financial security and independence post-retirement.

Is EPF available for private employees?

The Employee Provident Fund is open for employees of both the Public and Private Sectors, which means all employees can apply to become a member of EPF India. Any organization that employs at least 20 individuals is considered liable to extend the benefits of EPF to its employees.

What is Employee Pension Scheme 1995 or EPS 95?

EPS 95, also called the Employee Pension Scheme 1995, is a type of social security scheme launched by the Employees’ Provident Fund Organization (EPFO) on 19th November 1995. The Employee Pension Scheme, in effect since November 16, 1995, applies to all employees of factories and establishments covered under the 1952 Miscellaneous Provisions Act and Employees Provident Funds.

The EPS benefits stand available for both new and existing EPF members. Here, both the employee and employer contribute 12% of the employee’s wage, including the basic salary and DA, to the scheme. Every month the employee's complete contribution is made to the EPF. Subsequently, 8.33% of the employer’s contribution goes to the EPS, and the remaining 3.67% goes to the EPF.

What happens to your EPF money after you retire?

Your EPF membership will continue, as the employer's portion is paid only after age 58. You can however withdraw 90% of your entire EPF amount after the age of 57. As per the norm, the employee contributes 12% of the basic pay plus Dearness Allowance, to the PF account.

How much will I get from EPF after retirement?

This calculation is determined by using the formula:

(Pensionable Salary X Pensionable Service)/70

How to check pension amount in EPFO?

Step 1: Visit the official website of EPFO.

Step 2: Find the "Online Service" section mentioned in its homepage.

Step 3: Click on “Pensioner's Portal” under 'Online Services' section

Step 4: On a new page named “Welcome to Pensioner's Portal”, click on “Know Your Pension Status”.

When do tax rates apply?

After last contribution ceases, the interest accrues for 36 months from thereon. But this interest is taxable, taxed at slab rate. After 36 months, EPFO account becomes inoperative. No interest is accrued. When retiring after 55 years, interest is accrued for 36 months after last employer contribution.

How to declare tax?

Check passbook on EPFO portal.

Calculate and add interest credit since last contribution.

Declare under income from other sources.

Pay tax at your income slab rate.

Can you delay tax liability?

No, effectively accrual methodology will apply.so, interest becomes taxable in the financial year in which it accrues.

Post – tax interest rate at highest slab rate of 30%

EPF notified rate 8.25%

Assumed tax rate 30%

Post tax rate 5.77%

FAQ on EPF

How does the PF amount from defaulting members get recovered?

Prosecution under Section 14, realization of debtors' dues, attachments of bank accounts, attachment and sale of properties, and detention and arrest of the employer are some of the methods used to recover the PF amount from employers.

Who should an employee contact if he or she is denied PF membership?

The employee must first approach the employer. If the employer does not supply it, he or she may seek the Regional Provident Fund Commissioner of the PF office.

How will an employee know if he /she is a member of EPFO?

Check the Salary Slip: Your Member ID is often mentioned on your monthly salary slip. It's usually provided by your employer. 2. Ask Your Employer: If you can't find it on your salary slip, reach out to your HR or payroll department.

Is it possible for an employee to contribute to EPF after leaving a job?

No, an employee who has left the service cannot contribute to his or her EPF. The contributions of the employee and the employer must be matched.

Is there an age criteria for employees who want to join EPF?

No. There are no age restrictions for employees to join the Provident Fund. However, if the employee has already reached the age of 58, he or she cannot join the Pension Fund.

When an employee is paid on a daily or partial basis, how is the EPF contribution calculated?

The amount of EPF contribution is determined by the wage paid in a calendar month.

Whether an employer can deduct employer’s share of contribution from the wages of employees?

No. It is not permissible. Any such deduction is a criminal offence.

Can the wages be reduced by the employer on account of payment to the EPF?

No. It is specifically barred under section-12 of the EPF & MP Act,1952.

Whether a daily rated employee or the piece rated employee can become a member of the EPF?

Yes.

If an employee is paid wages on daily basis or on piece rate basis how the contribution is determined?

The wages paid in a calendar month will be taken to determine the contribution due.

Is EPF deducted on stipend?

A trainee or an intern is not an employee by the definition of the Act and the schemes defined under the Act. EPF is not deducted from the stipend earned by a trainee or an intern subject to the condition that such trainees are covered under either the Apprenticeship Act or Industrial Employment (standing orders) Act or the interns are engaged through recognized institutions undergoing on-job training as part of their curriculum.

Is EPF optional for employees? Can an employee opt out from the Schemes under EPF Act?

An employee with a basic salary of over Rs. 15,000 and who has never been a member of EPF can opt out of the scheme. But once they become a member, they cannot opt out of the scheme.

Whether the member is entitled for full interest on the belated deposit of PF dues by the employer?

After realizing the dues, the PF members will be given full interest for each due month, and it will in no way affect the interest due to members on the contributions paid. The employer shall be charged penal interest under Section 7Q and penal damages under Section 14B of the Act respectively.

An employee is paid subsistence allowance during the period of his suspension. Whether PF contribution is payable on this?

No.

The contribution has been recovered from the wages of the employee, but the employer had not paid to the EPF. What is the remedy?

The Employees’ PF Organization will invoke penal provisions of the Act to recover the dues from the employer. Complaint can be lodged with Police under section-406/409 of IPC by the EPFO for action against such employers.

When can I withdraw money from my EPF account?

You can only withdraw money for personal purposes:

- After you have completed 7 years of service

- Only thrice during the EPF account’s duration

- You cannot withdraw more than 50% of your personal contribution.

What will be the effect of non-payment of PF dues by an employer? Or how a member is affected for non-payment of EPF dues by the employer?

The Provident Fund amount due to the member will be paid only to the extent of the amount realized from the employer.

How a member is informed about the non-payment of contributions recovered from the wages of the employee but not paid to the EPF?

The Annual P.F. Statement of Account/Member Passbook will indicate the amount paid by the employer. The default period in a year is thus made known to the members. In the current scenario if the member has activated her/his UAN the non-payment/payment of contributions can be verified every month through the e-passbook. Currently, members also receive SMS on their registered mobile phones on credit of monthly contribution into their PF account.

When an employer becomes insolvent or when a company is wound up, whether the contributions will be paid in priority over other debts?

Yes.

Can a member pay contribution in excess of the statutory rate of 12%?

Yes. The member can pay voluntary contribution in excess of his normal contribution of 12% of Rs.15000/-. The total contribution i.e., voluntary + mandatory can be up to Rs.15000/- per month. (The employer may restrict his own share to the statutory rate). The member can also contribute on higher wages i.e., >15000/- after getting permission from APFC/RPFC as per the provisions of para-26(6) of the Scheme.

Whether an employer can stop paying Employees’ Provident Fund contribution in respect of a member who had attained the age of 55 or 60?

No. The Employees’ Provident Fund Contribution should be paid till the date of his leaving the service, irrespective of the age of the member. Employees who ceases to be EPS (pension) member will get Employers 8.33% contribution in PF.

In case the PF amount is not settled within 20 days to whom the matter is to be reported?

He can approach the Regional P.F. Commissioner in charge of grievances; file a complaint on the website using the EPFiGMS feature in the section ‘FOR EMPLOYEES’. The URL for the grievance page is http://epfigms.gov.in/ or he can appear before the Commissioner in the ‘Nidhi Apke Nikat’ program being conducted on 10th of every month.

Is there any time limit for withdrawal of Provident Fund dues?

Only in the case of resignation from service (not superannuation) does a member has to wait for a period of two months for withdrawal of the PF amount.

Can an employee withdraw 90% of his/her PF?

EPFO allows members 54 years or older to withdraw up to 90% of their EPF balance one year before retirement.

In case of change in employment whether a member can get his PF account transferred?

On change in employment, the member should necessarily get his PF account transferred to his present establishment, duly submitting Form 13(R). A member can submit claim for transfer online using member interface at unified portal.

If an employee is not given the PF membership, to whom he can approach?

He can approach his employer failing which he can approach the Regional Provident Fund Commissioner of the nearest PF office.

Can an employee become a member of EPF without any age restriction?

There is no age restriction for becoming a member of the Provident Fund, whereas an employee who has already attained the age of 58 cannot become a member of the Pension Fund.

Whether an apprentice can become a member of the EPF?

No. But, when he ceases to be an apprentice he should be enrolled immediately.

Whether an EPF member can discontinue his membership while in employment?

Not permissible.

How long an employee can continue his EPF membership?

There is no restriction of period for membership. Even after leaving the establishment a person can continue his membership. However, if no contribution is received into a PF account for 3 consecutive years the account shall not earn any interest after 3 years from the stopping of contribution.

If the establishment is not employing 20 persons, whether an employee can join the EPF?

Yes. The majority of employees and the employer can voluntarily opt for joining the Scheme as per provisions of Section-1(4) of the Act (Voluntary Coverage)

Can I surrender or sell my full pension for getting a lump sum payment?

No.

If a member is having two wives to whom the family pension is payable?

If the second marriage is legally valid, it is payable to the eldest wife with reference to the date of marriage and on her death, payable to the next surviving widow.

What will be the effect of unemployment period under the Pension Scheme?

The unemployment period will be excluded from the actual service. Pension is based on contributory service only.

If an employee is drawing more than Rs. 15000/- (Basic + DA only) is he required to become a member of the EPF?

Such employee is not required to become a member, if he is not already holding the PF membership. Otherwise, if both the employer and employee are willing, he can become a member by giving option under Para-26 (6) of the PF Scheme. The option has to be submitted to the EPF office within 6 months of joining such member.

If an employee is transferred from one establishment to another establishment whether he is required to be enrolled as a member once again?

He is required to be enrolled as a member under the new establishment, for transferring his Provident Fund from his previous account.

Whether an employee can become a member of the Pension Scheme only, without contributing to the PF?

No. By virtue of membership of Provident Fund only one can become a member of the Pension Scheme. From 01/09/2014 any new employee joining an establishment and drawing basic wage more than Rs.15000/- per month can only become a member of the PF after submitting option as per the provisions of Para 26(6) of the EPF Scheme. However, he cannot get membership to the Pension Fund. Both employee share of 12% and employer share of 12% contribution shall be paid into the Provident Fund only for all such employees.

Whether an employee can continue as a PF member even after his retirement?

Yes. If one continues to work even after attaining the superannuation age.

Is there any option available to an employee whether to become a member of the EPF or not?

No option.

Whether an EPF member can discontinue his membership, while in employment?

Not permissible.

How long an employee can continue his EPF membership?

There is no restriction of period for membership. Even after leaving the establishment a person can continue his membership. However, if no contribution is received into a PF account for 3 consecutive years the account shall not earn any interest after 3 years from the stopping of contribution.

How the period of non-employment between two spells of employment is treated under EPF?

Non employment period is not affecting the EPF but affects the calculation of service to decide the quantum of benefit under the Employees’ Pension Scheme.

What will happen for the EPF membership of an employee during the period of closure, lock-out, strike etc.?

During such period the membership will continue and in the absence of wages no recovery of contribution will be made.

Whether an employer can also join the PF?

No.

A Security Guard is working for different establishments; under whom he is required to secure membership?

If the employer of the Security Guard has been brought under the Act, the membership will be given through the employer, irrespective of his place of work.

If the establishment is not employing 20 persons, whether an employee can join the EPF?

Yes. The majority of employees and the employer can voluntarily opt for joining the Scheme as per provisions of Section-1(4) of the Act (Voluntary Coverage).

What other benefits are accrued on joining the EPF?

On joining the EPF, the member is provided the benefits under Pension (restricted to employees with Rs.15000/- or less monthly wage) and Employees’ Deposit Linked Insurance Scheme.

Whether an employee already drawing Pension under EPS, 1995 is required to join the PF and Pension Fund?

He is required to join only the PF and he cannot become a member of the Pension Scheme.

An employee who joins an establishment at the age of 58 is eligible to become a member of the Pension Fund?

No.

How long a member can retain his Provident Fund in his account?

The membership can be retained till the withdrawal of his Provident Fund dues. However, if the account does not receive any contributions for more than 3 years interest won’t be credited to the account after the 3rd year.

EDLI – Employees Deposit Linked Insurance Scheme

The Employees Deposit Linked Insurance Scheme (EDLI), initiated by the Government in 1976, aims to offer social security benefits to private sector employees who often lack such protections from their employers. Currently, the scheme is overseen by the Employees Provident Fund Organization (EPFO) and provides term life insurance coverage for participating employees.

Organizations that are eligible for EPF also become eligible for EDLI. Every month, the employer contributes to the EDLI scheme when a contribution to the EPF account is made. The EDLI charges in PF is as follows -

12% of the basic salary + Dearness Allowance towards the EPF Account

12% of the employee’s basic salary + dearness allowance which is apportioned as follows -

3.67% to the EPF Account

8.33%, subject to a maximum of Rs.1250, to the EPS (Employees’ Pension Scheme)

0.50%, subject to a maximum of Rs.75, to the EDLI Account

Employers can choose a group life insurance scheme for their employees, which must provide coverage equal to or greater than the EDLI scheme. If they opt for this scheme, they can withdraw from EDLI. However, if no group life insurance is selected, the EDLI contribution limit can be increased to Rs. 15,000 per month.

We have endeavored to address all pertinent inquiries one might have concerning the Employees' Provident Fund (EPF). This article will be revised in the future in accordance with any changes or advancements in government rules and regulations.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts