-A CASE STUDY ON WEALTH PRESERVATION AND WEALTH PROTECTION

Mr. Manohar Apte, aged around 53 years, had been working as a deputy manager of a public sector bank. Started in the clerical cadre almost two and half decades back, he could have climbed the corporate ladder much faster but for his interest in politics, which had prevented him from accepting promotions due to him. During his entire life, he had paid very little time and energy to arrange his finances and saved little beyond the statutory minimum. The sudden detection of carcinoma and his death following a brief period of treatment was therefore a shattering experience for his whole family both emotionally and financially.

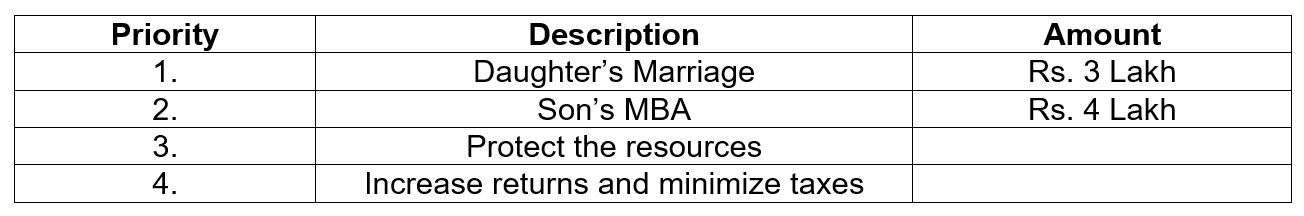

When Mrs. Apte, who is now 45 years old, approached us for advice, we found that she does not have a clue about her late husband’s finances and is much worried about her daughter Smitha’ marriage. She estimated that the expenses in her daughter’s marriage would come to Rs. 3 Lakh. Her son Rahul, now twenty years is pursuing his final year graduation and would like to go in for an MBA program, which may cost her another Rs. 4 Lakh. Her next concern is Mr. Apte’s mother, who is now 80 years old and staying with the family. Her family expenses runs to Rs. 180000/- per annum (which includes the children’s education and Mr. Apte’s personal expenses of Rs. 36000/- per annum).

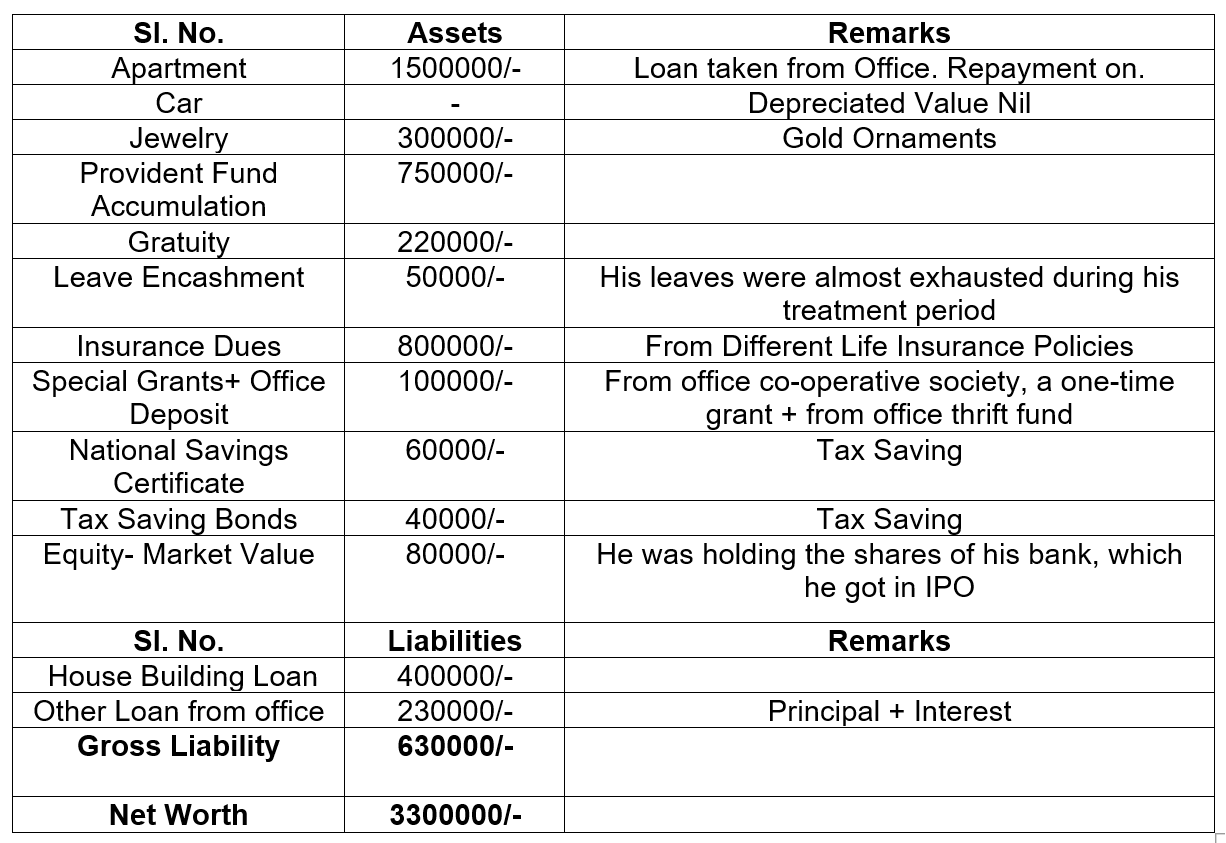

The data provided by Mrs. Apte was not sufficient to prepare a comprehensive financial plan for her, so we requested Mrs. Apte to allow us to meet the Tax Lawyer, Insurance Advisor of the Apte family as well as the HR Manager of the Bank in which Mr. Apte was working. Through the following week, these meetings took place, and we collected and collated the data, which gives us a detailed idea of the Apte’s Net Worth.

Net-Worth of the Apte Family

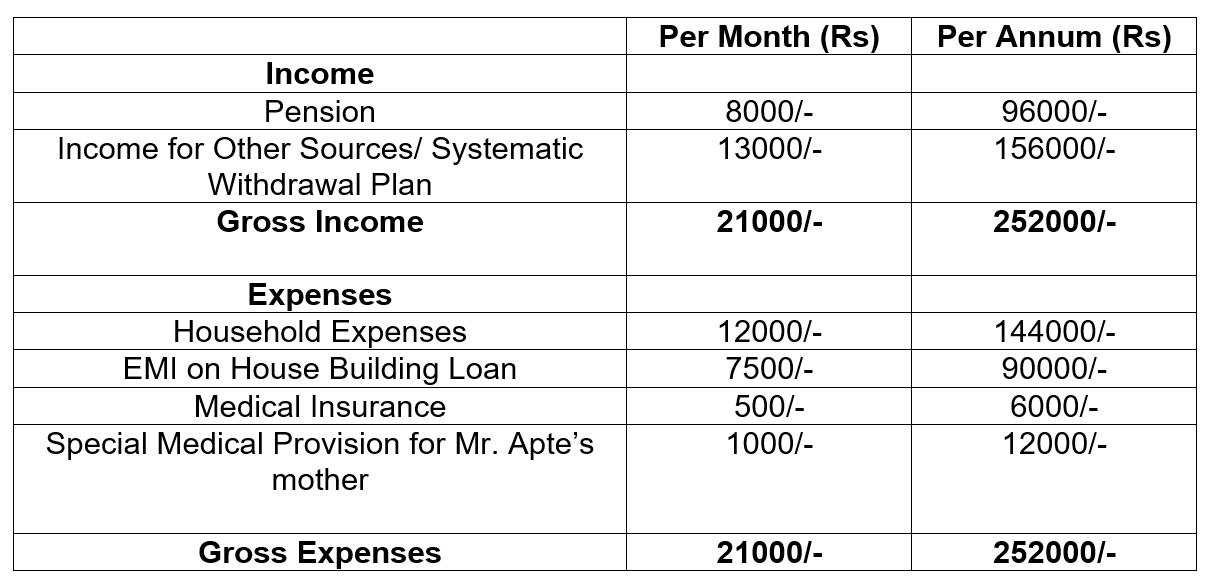

Further Mrs. Apte is entitled to get a Family Pension of Rs. 8000/- per month for the first 5 years which will be reduced to Rs. 3000/- per month from then onwards.

The bank has taken care of the treatment costs of Mr. Apte, which ran into almost Rs. 450000/-. However, henceforth Mrs. Apte and her family will not be enjoying any Medical Cover from bank.

Recommendations

Financial Objectives

Based on the information obtained by us, we have prepared a list that reflects the family’s goals, which are quantified, wherever possible. An Action Plan later lists the method of achieving these goals.

Action Plan

Diagnosis of the Family’s Assets reveals that around Rs. 15 Lakh is in real estate, Rs. 3 Lakh is in jewelry and Rs. 21 Lakh is securities and cash.

There would be an immediate short-term requirement of Rs. 3 Lakh for daughter’s marriage, which includes Gold ornaments worth Rs. 1.5 Lakh, which Mrs. Apte already having. Thus, an investment of Rs. 1.5 Lakh in a Floating Rate Debt Mutual Fund will meet the requirement.

The other loan of Rs. 2.30 Lakh from office carries an interest of 12% per annum and same be retired immediately from available fund.

The House Building Loan of Rs. 4 Lakh will be repaid in the next 5 years as per original schedule. The EMI will come to Rs. 7500/- per month. This repayment will also provide Tax Relief for the family income.

So far Rahul’s MBA expenses are concerned, he is advised to go for an Educational Loan. This will serve two purposes. The capital in the hands of the family remains intact. As a 2nd benefit, Rahul will also enjoy tax benefit under section 80E of Income Tax Act 1961, at the time of repayment.

After the above allocations and loan repayment, the investible fund in Mrs. Apte’s hand comes to Rs. 1570000/- only. Out of the quantum of investible fund, Rs. 6 Lakh be invested in PO MIS, which will generate Rs. 4000/- per month. Rs. 4 Lakh be invested in Bank FD for 5 years term generating another 2200/- per month. Rs. 3.5 Lakh in a Short-Term Debt based mutual fund from where a systematic withdrawal of Rs.6800/- be made for the next 5 years and Rs. 50,000/- be left in a Savings Bank account to meet short term contingencies. This leaves us with another Rs. 1.7 Lakh, which may be invested in diversified equity oriented Mutual Fund in a systematic manner.

The Apte’s shall take a Cash Less Medical insurance of Rs. 2 Lac each at a cost of Rs. 6000/- per annum only. Since the mother of Mr. Apte cannot be covered under Medical Insurance, a special provision of Rs. 12000/- per annum need to be made to cover her illness.

The Family Income-Expenses Projection

The family is going through a phase of transition and the finance needs to be monitored regularly. As we can see that only a minimal quantum of allocation is made to growth-oriented assets like equity (Rs. 2.5 Lakh including the Bank Shares), which has a track record of beating inflation. Such insignificant allocation to equities might be detrimental to Mrs. Apte, who expectedly would live for around 35-40 more years. However, with passing time as her daughter gets married, son leaves home for MBA program which will be financed by loan and later on get a job, surplus cash generation will increase which can be routed more to growth-oriented assets. So right now, we have concentrated more on Wealth Preservation and Wealth Protection. Wealth Accumulation will be considered at time that is more opportune.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts