AGE AND AFFLUENCE : A GUIDE TO AGE APPROPRIATE FINANCIAL BENCHMARKING

- Sun Jun 22 18:30:00 UTC 2025

- In Personal Finance by Aparna Bose

Navigating the journey of personal finance is akin to charting a course through uncharted waters—especially as you transition through the pivotal decades of your life. Each stage, from your 20s through your 60s, presents unique financial challenges and opportunities that can significantly impact your long-term wealth. This article aims at providing you with key insights and benchmarks to help you make informed financial decisions throughout your life’s journey. Whether you are just starting out or approaching retirement, understanding the importance of strategic wealth accumulation will be essential to achieving your financial aspirations.

In Your 20s

Even saving or investing as little as Rs 2–5 lakh can set you apart from many of your peers. In urban India, individuals in their 20s typically have a net worth of less than Rs 2.5 lakh. To get ahead, cultivate early investment habits such as regular Systematic Investment Plans (SIPs), maintaining a basic emergency fund, and steering clear of lifestyle traps.

In Your 30s

While your income is likely to increase, so will your expenses related to marriage, EMIs, and children. The median net worth for salaried professionals in this age group falls between Rs 20–30 lakh. Aiming for a net worth of over Rs 45 lakh can help ensure you're on the right path toward financial freedom.

In Your 40s

This decade is crucial for wealth accumulation. If your net worth across various assets—such as Employee Provident Fund (EPF), mutual funds, Public Provident Fund (PPF), and real estate—exceeds Rs 50 lakh, you are likely healthier financially than most of your contemporaries. A net worth nearing Rs 85 lakh indicates you are doing exceptionally well.

In Your 50s

As you approach retirement, your financial corpus should ideally total around Rs 1 crore by age 50, reflecting your nearly 30 years of work. If you've amassed between Rs 75 lakh and Rs 1.2 crore, you are on the right track for retirement readiness. You may consider reallocating your assets at this juncture.

In Your 60s

Having Rs 1.6 crore at or after 60 can signify true financial freedom. By this age, your focus should shift to a structured withdrawal strategy rather than chasing aggressive returns. Achieving a net worth in the range of Rs 90 lakh to Rs 1.6 crore positions you above the national average for retirees.

Throughout this financial journey, your efforts have enabled you to achieve these milestones, and you deserve a say in how your wealth is utilized. Regardless of whether you are a young investor, a homemaker, or a professional, it is crucial to educate yourself about the basics of investing. Ensure your money works for you by adopting smarter strategies. If a family member is managing your investments, make it a point to stay informed and involved in the decision-making process. Discuss how each person will contribute to the household’s financial pool.

At our firm “Investaffairs”, we specialize in mutual fund distribution and are committed to providing you with the insights you need. The aim of our blogs is to empower our clients regarding their financial matters. Feel free to reach out to us—whether by phone, in person, or through email—and engage with our experts as often as needed. Always seek clarity on your investments. Invest more but do so with informed understanding.

Keep in mind that it's never too late to begin your investment journey. The team at Investaffairs, a boutique MF distribution firm, is skilled in managing your finances and customizing your investments to meet your specific needs and goals.

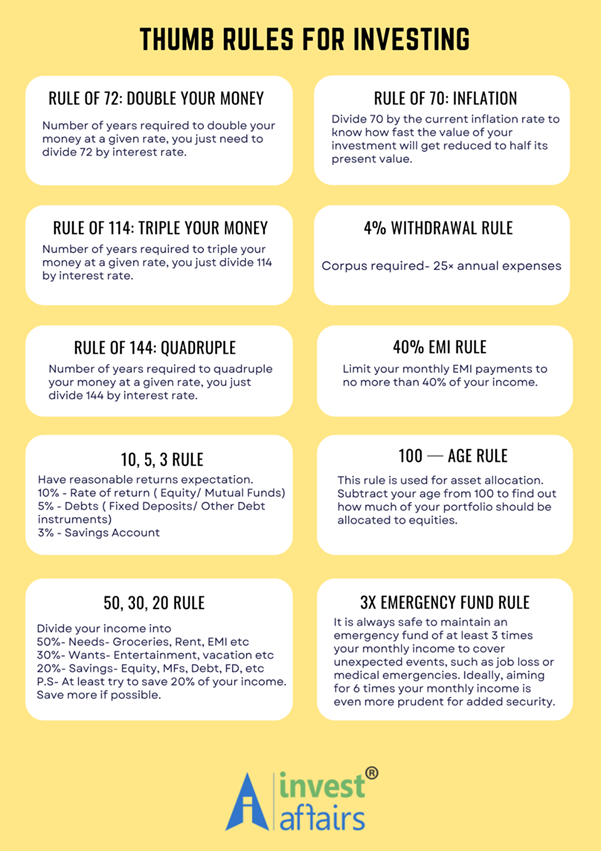

THUMB RULES TO MULTIPLY YOUR CORPUS

Investing can often seem overwhelming, but simplifying strategies and wise investment discipline can pave the way for smarter financial decisions and wealth accumulation.

By incorporating a few thumb rules (in the picture) into your financial planning, you can create a strategic approach to wealth accumulation and management. Whether you're saving for retirement, an emergency, or simply aiming for financial independence, these guidelines provide a foundation for sound investing decisions. Start setting your financial goals today and let these rules help you multiply your corpus effectively. Once again, we encourage you to visit our office or connect with us via Google Meet to gain clarity and explore your wealth creation journey. Your understanding is important to us!

In sum, understanding your financial standing and strategies at each stage of life is vital for building wealth. By adopting strategic investment habits and adhering to practical rules, you can navigate your financial journey more effectively. Remember, it’s never too late to start investing. Seek professional guidance, stay informed, and make your money work for you to achieve long-term financial stability.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts