A HINDU UNDIVIDED FAMILY (HUF): A COMPREHENSIVE GUIDE TO FORMATION, INVESTMENTS AND TAX BENEFITS

- Sun May 25 18:30:00 UTC 2025

- In mentoring and guidance by Aparna Bose

According to section 2(31) of the Income-tax Act, 1961, a Hindu Undivided Family (HUF) is defined as a family unit comprising the lineal descendants of a common ancestor. A HUF includes unmarried daughters too. This unit is recognized as a “Separate Tax Entity” and is classified as a “Person” for taxation purposes. HUFs can be established by families belonging to Hindu, Buddhist, Jain, or Sikh religions/ communities.

The head of the HUF is referred to as the "Karta," who is legally empowered to make decisions on behalf of the family. Contrary to common misconceptions, a woman can also serve as a Karta. Although initially only male members were considered coparceners, but after the 2005 amendment to the Hindu Succession Act, daughters too have been granted equal coparcenary rights.

Notably, Individuals within four generations of the Karta who acquire an interest in the joint family property by birth can demand a partition and an inherent share in the joint family property. While individual family members have their own PAN cards, the HUF is assigned a separate PAN card. This distinct identity allows HUFs to engage in various financial transactions and invest in financial securities.

In this blog, we will focus on the legal aspects related to the formation of a Hindu Undivided Family (HUF) in the context of mutual fund investments. The initial step in building a portfolio is to complete the Know Your Customer (KYC) formalities, just like any other investor.

KYC FORMALITIES

The Karta will need to complete the required formalities with the central registration agency. While filling out the KYC Form, the Karta needs to opt for the “Non-Individual” category and mention HUF along with his or her name.

The following documents need to be shared with the agency:

- The PAN Card of HUF and the Karta

- HUF’s Passbook or statement from the Bank

- Photograph

- Identity Proof issued by a government body

- Address Proof

- Deed of declaration or the List with the names of the coparceners

- Details of the Karta (also referred to as Ultimate Beneficiary Owner or UBO)

- Foreign Account Tax Compliance Act (FATCA) Form

All the above mentioned documents need to be self-attested by the Karta and contain the HUF stamp.

KIN

Once the KYC process is successfully completed, a 14-digit unique number referred as the KYC Identification Number (KIN) is generated. The KIN is e-mailed to the Karta in about 15 days after the verification process.

APPLICATION FOR INVESTMENT IN THE MUTUAL FUND

The Karta should explicitly mention “Hindu Undivided Family (HUF)” after his or her name in order to differentiate it from personal investments.

HUF investments and portfolios (even demat accounts) are held and operated solely on a solo holder basis. An HUF is not allowed to allocate a nominee for any of its holdings.

MARRIAGE IMPLICATION ON HUF

When a male member marries, his wife becomes a member of the HUF. However, she does not acquire the status of a coparcener because coparcenary rights are only given to lineal descendants of a common ancestor within four generations. Also, she has no right to demand partition or claim an independent share of her husband’s HUF property. Upon marriage, the children born by the couple automatically become coparceners of the HUF. When the daughter gets married, she continues to hold coparcenary rights in her father’s HUF and becomes a member of her husband’s HUF.

It is interesting to note that a HUF can be created within a HUF. For example, a son can have his own HUF and continue to be a member of his father’s HUF. However, in his own HUF he is the “Karta” but in his father’s HUF he is a coparcener.

BENEFITS OF HUF

From a legal standpoint, a Hindu Undivided Family (HUF) is considered a distinct entity. Each family member holds their own PAN card, while the HUF possesses a separate PAN card as well. An HUF is allowed to operate its own business and can invest in shares and mutual funds. As an independent entity, the HUF benefits from a basic tax exemption of Rs 2.5 lakh. For instance, if you establish an HUF that includes yourself, your spouse, and your two children, you not only enjoy individual income tax benefits but can also take advantage of an additional basic income tax exemption of Rs 2.5 lakh per year.

What are the Tax benefits for HUFs?

A HUF is eligible for the tax exemptions available under Sections 80C, 80D, and 80G of the income tax regulations.

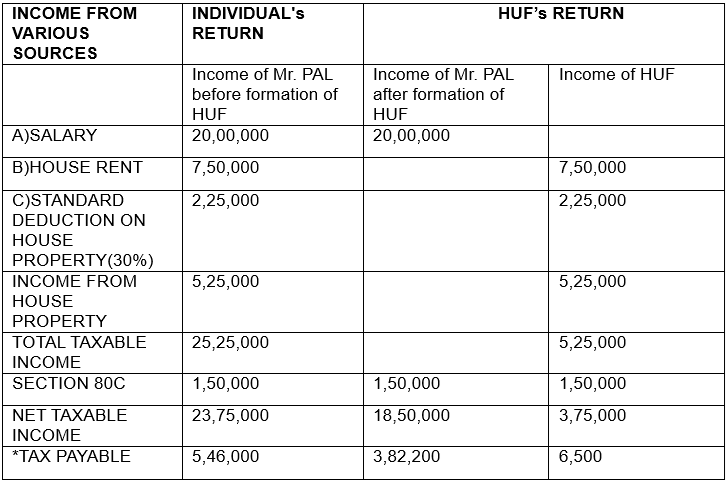

To illustrate how an HUF is taxed, let’s consider the following example: Following the death of his father, Mr. Haridas Pal decides to establish a HUF with his wife, son, and daughter as its members. Since Mr. Pal did not have any siblings, the property owned by his father was transferred to the HUF. This property generates an annual rental income of Rs 7.5 lakhs. Additionally, Mr. Haridas Pal earns a salary of Rs 20 lakhs. Please refer to the table to see how Mr. Pal can reduce his tax liability by forming a HUF:

Total tax to be paid by Mr. Pal- 5,46,000

Total tax to be paid by Mr.Pal & HUF- 3,88,700

Tax savings due to forming an HUF- 1,57,300

* Calculations based on Slab rates of the old regime including health and education cess of 4%

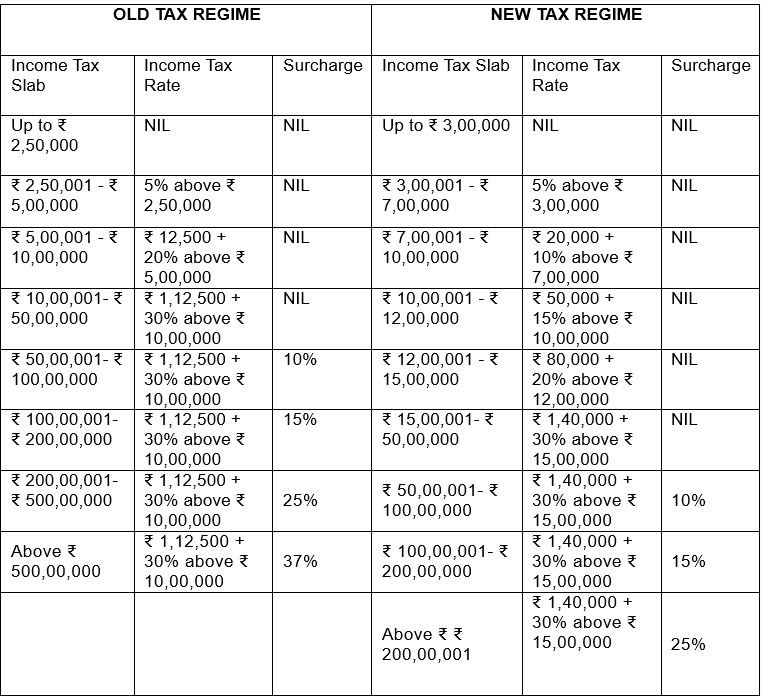

TAX RATES FOR HUFS (RESIDENT OR NON-RESIDENT) DURING THE PREVIOUS YEAR:

WEALTH MANAGEMENT

HUF allows for the joint management of family wealth. Ancestral assets such as properties, businesses, or investments can be managed under one umbrella entity. It is worth noting that a woman who enters the Hindu Undivided Family by way of marriage is only considered a member and not a coparcener. Hence, wives and daughters-in-law cannot become Karta in an HUF.

For instance, a wife cannot become the Karta of a HUF after the demise of her husband. If the husband does not have siblings and the children are also minors, then in case of his death, his wife can only act as its manager till the older child achieves the age of majority.

HOW TO CREATE HUF?

The process of HUF creation starts with the creation of a HUF DEED, which includes

- Declaration by family members stating the creation of the HUF,

- Names of the Karta and all coparceners (members),

- Details of contributions made by family members.

- Next, fill out Form 49A online to apply for a HUF PAN card.

- Open a separate bank account under the name HUF. This account will be used for all financial transactions, including investments and income the HUF earns.

When it comes to investing, HUFs have a variety of options. Mutual Funds and Portfolio Management Services (PMS) are two of the most prominent choices.

Further, to redeem mutual fund units held in a Hindu Undivided Family (HUF) account, the Karta of the HUF (acting as the representative) must sign the redemption request form and affix the HUF's rubber stamp. The form should be submitted to the Asset Management Company (AMC) or their designated office. Redemption can also be done online if an IIN has been created via NSE-NMF platform as is the case with our HUF investors. The online transactions are always hassle-free if and when carried out by a well versed operations and services desk of a mutual fund distribution firm or company.

3. Additional Considerations:

Bank Account:

The redemption proceeds will be credited to the registered bank account of the first-named unit holder.

Transmission of Units:

If there is a change in the Karta, proper documentation is required, including a request form, death certificate (if applicable), bank letter, KYC documents, and an indemnity bond signed by all surviving coparceners.

HUF DEED

One has to prepare a deed on stamp paper declaring the formation of the HUF. It should have all the details, including the name of Karta, co-parceners, address and source of funds in the corpus. Once the declaration deed is made, the Karta can apply for a permanent account number (PAN) for the HUF.

FAQ

Who Cannot open a HUF account?

One person cannot form HUF, it can only be formed by a family

How can a HUF invest in mutual funds through a distributor?

The Karta is required to fill up the non-individual KYC form and complete KYC formalities with the registration agency (KRA).

The following documents must be attached with the KYC application:

- PAN of HUF

- Deed of declaration of HUF/ List of coparceners

- Bank passbook/bank statement in the name of HUF

- Photograph, proof of identity, proof of address and PAN of Karta All documents should be self-attested by the Karta.

Next, the Karta has to fill up the mutual fund application form. Bank details of the HUF, PAN, deed of declaration of HUF or list of coparceners have to be provided. The application should be supported by a cheque for investment amount in favour of the desired scheme.

The application form should be submitted to an AMC or given to the distributor for processing. Applications received before cutoff timing will be allotted NAV as per SEBI regulations and account statement for the same will be sent to the registered email id for the records of the HUF.

POINTS TO NOTE

Karta has to add HUF after his name to distinguish it from his personal investments.

Karta has to put his/her stamp along with the signature on the required field. HUF stamp is mandatory.

All HUF accounts and folios can be held and operated only on a “Single Holder” basis.

Can Muslims form a HUF?

HUF can be formed by the Hindu caste as well as Buddhists, Jains, and Sikhs. But Muslims, Christians, or Parsis cannot form HUFs.

Can a salaried person create HUF?

Yes, a salaried person can form HUF to manage ancestral property or pool family assets. However, salary income cannot be included as HUF revenue.

What are the income sources for a HUF?

A HUF can earn income from various sources such as a family business, rental properties, and interest on deposits. Investing pooled family funds can build long-term wealth and offer tax benefits. It's important to keep all family funds in a single bank account under the Karta's name, with all transactions approved by the Karta.

Are there any incomes which are not taxed as income of HUF?

The following incomes are not taxed as HUF income:

a. If a member transfers their self-acquired property to the HUF without receiving appropriate sale consideration, any income generated from that property remains taxable to the individual member rather than the HUF.

b. Personal income earned by HUF members is not classified as HUF income. Specifically, "Stridhan," which is considered the absolute property of a woman, is not taxable as HUF income.

c. Income derived from an individual property owned by a daughter is not subject to HUF taxation, even if that property is transferred to the HUF by the daughter.

Can a HUF get Senior Citizen Benefits?

While the members of HUF above the age of 60 years can avail of senior citizen benefits individually, the HUF cannot avail of any benefit that is available to the senior citizens. For example, the Karta (senior citizen) can get a health insurance premium deduction of 50,000, but the HUF can only avail of a deduction of Rs.25,000.

Can a married daughter be part of HUF?

Yes, a married daughter can be a part of her father's Hindu Undivided Family (HUF), even after marriage. She is considered a member of her father's HUF and retains her rights in the family's property. She becomes a member of her husband's HUF as well, but this doesn't affect her rights in her father's HUF.

Can HUFs apply in mutual funds and invest in tax-saving funds?

The simple answer is yes, HUFs can generally get registered with the nearest KYC Registration Agency (KRA)y filing a duly signed KYC form with relevant documents like Pan of HUF; List of coparceners; Bank passbook/bank statement in the name of HUF; Photograph, proof of identity, proof of address and PAN of Karta All documents should be self-attested by the Karta. The list is not exhaustive, and there may be additional documentation that may be required.

Can a HUF claim tax benefits under 80C when investing in ELSS funds?

Yes, a HUF can claim tax benefits under Section 80C when investing in ELSS funds.

What happens to HUF after Karta dies?

Upon the death of the Karta, the surviving members of the HUF can appoint the eldest surviving male as the new Karta. This transition ensures the continuity of the family's legal and financial matters under the new leadership.

Can wife be considered a coparcener in HUF?

Coparcenary rights are generally reserved for lineal descendants born into the family. Although a wife is recognized as a member of the HUF, she does not possess the rights associated with a coparcener.

Is it possible for an unmarried family member to be a coparcener in an HUF?

Yes, an unmarried individual can indeed be a coparcener in a Hindu Undivided Family (HUF) and is eligible to invest in mutual funds through the HUF.

How to appoint a new Karta for a HUF?

To appoint a new Karta for a Hindu Undivided Family (HUF), usually following the death of the previous Karta, the remaining members of the HUF designate a new Karta, typically the eldest surviving male member. This process requires the submission of essential documents, such as a death certificate and a declaration from the surviving members to the appropriate authorities with guidance from your experts who manage your investments.

Is it mandatory to file ITR for HUF?

Individuals, except senior citizens, have to mandatorily file the ITR through the online mode, which is also known as electronic filing, i.e. E-filing of the income tax return.

What is HUF PAN Card?

A HUF PAN is specialised PAN Card is exclusively issued to Karta and is primarily used for taxation purpose. It's crucial to understand that only Karta has the authority to apply for and hold a HUF PAN Card.

How to apply for a HUF PAN card?

You can apply for a HUF PAN card online or offline. Here are both procedures:

Online Application Process for Applying HUF PAN Card

To apply for a HUF PAN Card online, follow these steps:

- Visit PAN Card Apply Online website

- Choose 'Business PAN Card

- Complete the online form with the necessary details

- Submit the form

- Pay the processing fee

- Send the required documents for verification

- Wait for document verification

- Once verified, your HUF PAN Card request will be processed

The new PAN Card will be sent to you

Offline Application Process for Applying HUF PAN Card

Applying for a HUF PAN Card offline involves these key steps:

- Locate a nearby authorised PAN Application Centre

- Collect Form 49A, the PAN Card application form

- Fill in the form accurately, including HUF and Karta details

- Attach required documents, like proof of identity and address, and HUF's existence proof

- Apply along with the processing fee payment

- Obtain an acknowledgement receipt with a unique 15-digit number

- Wait for document verification by the centre

- Once verified, the Income Tax Department processes the request

Receive the new HUF PAN Card at the provided address

What are the documents required for applying for a HUF pan card?

When applying for a HUF PAN Card, it is essential to provide a specific set of documents to establish the identity and structure of the HUF. The required documents typically include:

- Photo Identity Proof: This serves as identification for the head of the family (Karta) and can be one of the following: Aadhaar Card, Driving License, Passport, or any other government-issued photo ID.

- Address Proof: To verify the residential address of the Karta, you can submit documents like an Aadhaar Card (with an updated address), Passport, Electricity Bill (not older than 3 months), Bank Statement (not older than 3 months), Rental Agreement, or Voter ID Card.Collect Form 49A, the PAN Card application form

- Date of Birth Proof: To confirm Karta's date of birth, acceptable documents include an Aadhaar Card, Driving License, Passport, School Leaving Certificate, or Birth Certificate.

- Affidavit by the Karta: The Karta of the HUF must provide an affidavit stating the names, father's names, and addresses of all the coparceners (members) within the HUF. This affidavit helps in establishing the HUF's composition and structure.

Other Supporting Documents: Depending on specific situations or requirements, additional documents may be requested by the authorities. It is crucial to review the official guidelines and requirements during the application process to ensure compliance.

How much does it cost to apply for a HUF pan card?

To apply for a HUF PAN card, the charges vary based on the communication address. For Indian communication addresses, the *application fee is ₹93 (excluding Goods and Services Tax), while for foreign communication addresses, it is ₹864 (excluding GST).

* May change in future.

Payment options for the PAN application include credit/debit card, Demand draft or Net-banking. After paying the application fee, the following step is to dispatch the supporting documents through courier or post to Protean (previously known as NSDL eGov) or UTIITSL (UTI Infrastructure Technology and Services Limited).

The PAN application will be processed once the documents are received. It's crucial to select an appropriate payment method and to submit all required documents to ensure a seamless application process.

Can a HUF apply for dissolution?

Breaking a HUF requires the agreement of all concerned parties.

How is Residential Status of HUF assessed?

Resident: A HUF would be resident in India if the control and management of its affairs is situated wholly or partially in India.

If the Karta of a Hindu Undivided Family (HUF) is resident and ordinarily resident in India, then the HUF is also treated as resident and ordinarily resident.

However, if the Karta is resident but not ordinarily resident, then the HUF is considered resident but not ordinarily resident.

Non-Resident: If the control and management is situated wholly outside India, it would become a non-resident.

CONCLUSION

Establishing a Hindu Undivided Family (HUF) as a tax entity under the Income-tax Act, 1961, provides families with considerable financial and tax benefits. Understanding HUF formation and investment implications can help in effective wealth management and tax reduction. This structure not only supports financial goals but also strengthens family unity and preserves their legacy. Engaging knowledgeable mutual fund distributors like Investaffairs can further facilitate the HUF investment process.

This article is a work in progress. The write up will be updated as and when the legalities with respect to HUF undergo any kind of modification or change.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts