A GUIDE TO TAXATION OF CAPITAL GAINS FROM INDIAN MUTUAL FUNDS FOR NRIs IN US AND CANADA

- Tue Aug 20 18:30:00 UTC 2024

- In Mentoring and Guidance by Aparna Bose

NAVIGATING THE COMPLEX LANDSCAPE

A Non-Resident Indian (NRI) is an Indian citizen who lives outside of India, as defined by the Foreign Exchange Management Act (FEMA) of 1999. NRIs are allowed to invest in mutual funds in India. However, it's important that these investments are made through specific bank accounts—either an NRE (Non-Resident External) account or an NRO (Non-Resident Ordinary) account (of any bank) in India.

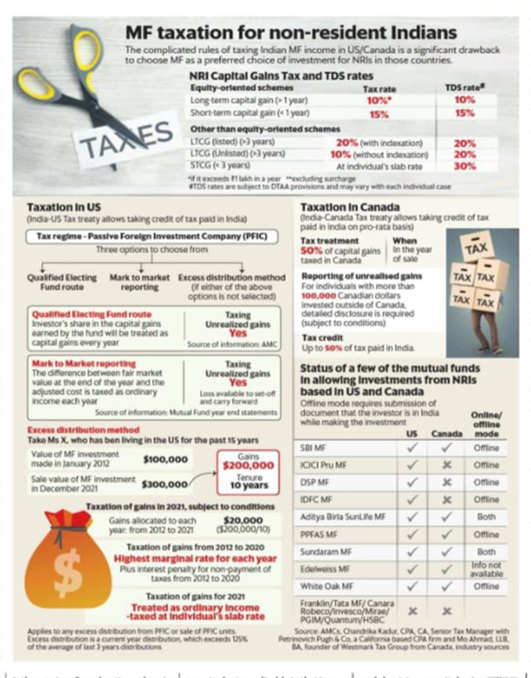

The rules regarding the taxation of income from Indian mutual funds in the US and Canada are quite complex. Additionally, the compliance requirements for asset management companies to allow NRIs to invest are strict. Some fund houses do not permit such investments, while others only allow them offline, requiring a declaration that the investor was based in India when making their first investment.

image courtesy-mint

FAQs

When is an individual considered a resident of the US or Canada for tax purposes?

When is an individual considered a US/Canada resident to comply with tax requirements?

US Tax Residency Rules

Threshold: 183 days is the critical threshold.

Calculation:

- Count all the days an individual was present in the US during the current year

- Add one-third of the days present in the previous year.

- Add one-sixth of the days present in the year before that

- If the sum exceeds 183 days, the individual is considered a US tax resident

Special Rule for Green Card Holders: Individuals who hold a Green Card (permanent residents) are automatically considered US tax residents, regardless of their physical presence in the US or the outcome of the Substantial Presence Test.

Canadian Tax Residency Rules:

183-Day Rule: Individuals who spend more than 183 days in Canada within a calendar year are generally considered Canadian tax residents.

- Alternative Determination: Tax residency can also be established based on "facts and circumstances," such as.

- Establishing a permanent home in Canada

- Having significant ties to Canada (e.g., a spouse or dependents residing in Canada, a driver's license, or a Canadian bank account).

How are Capital Gains from Investments in Indian Mutual Funds Taxed?

In the US:

Passive Foreign Investment Company (PFIC) Rules:

Indian mutual funds are classified under PFIC regulations, which are designed to discourage US taxpayers from investing in foreign mutual funds.

Income from these investments must be reported on Form 8621.

Taxation Methods:

- Excess Distribution Method (default option): Taxes are applied to the excess distributions received from the mutual fund

- Qualified Electing Fund (QEF) Method: This option allows the investor to pay taxes annually on their share of the mutual fund's earnings.

- Mark-to-Market Method: Investors can elect to pay taxes on the gains and losses in the fund's value as if they had sold their shares at the end of each tax year.

In Canada:

Capital Gains Tax: In Canada, capital gains are generally taxed at 50% of the gain, meaning only half of the gain is added to your taxable income. The rate you pay on this amount is based on your income tax bracket.

Foreign Tax Credit: Similar to the US, if you’ve paid taxes on the capital gains in India, you may be eligible for a foreign tax credit to avoid double taxation. This credit is claimed on your Canadian tax return and can offset Canadian taxes payable.

Reporting Requirements: You need to report foreign income and capital gains on your Canadian tax return. Additionally, if you have foreign assets worth over CAD 100,000, you may need to file Form T1135 (Foreign Income Verification Statement.

Given the complexities of international taxation, it’s advisable to consult with a tax professional who is knowledgeable about both US and Canadian tax laws to ensure compliance and optimize your tax situation.

Explain the Applicable Tax Rates?

The tax implications for Non-Resident Indians (NRIs) in the US and Canada on capital gains from Indian mutual funds depend on the type of mutual fund (equity or debt) and the holding period.

Equity Mutual Funds

Short-Term Capital Gains (STCG):

- Holding Period: Less than 12 months

- Tax Rate: 20%

Long-Term Capital Gains (LTCG):

- Holding Period: More than 12 months

- Tax Rate: 12.5% on gains exceeding INR 1.25 lakh per year

Debt Mutual Funds

Short-Term Capital Gains (STCG):

- Holding Period: Less than 36 months

- Tax Rate: As per the individual’s applicable income tax slab

Long-Term Capital Gains (LTCG):

- Holding Period: More than 36 months

- Tax Rate: 20% with indexation benefits

Additional Considerations :

Withholding Tax: India imposes Tax Deducted at Source (TDS) on capital gains for NRIs. For equity funds, TDS is 15% on STCG and 10% on LTCG. For debt funds, TDS is 30% on STCG (as per applicable tax slab) and 20% on LTCG.

Double Taxation Avoidance Agreement (DTAA): NRIs may claim a tax credit under the DTAA between India and the US or Canada to avoid double taxation on the same income.

Filing Requirements: NRIs must report these capital gains when filing taxes in their country of residence. The specific tax treatment will depend on local laws and the DTAA provisions.

Additional Points :

- Withholding Tax: India applies a Tax Deducted at Source (TDS) on capital gains for NRIs. For equity funds, TDS is 15% for STCG and 10% for LTCG. For debt funds, TDS is applied at 30% for STCG (as per applicable tax slab) and 20% for LTCG.

What are the tax credit provisions in the US or Canada for taxes already paid in India?

United States: The Foreign Tax Credit allows US taxpayers to offset income taxes paid to a foreign country, provided that the tax is considered to be imposed on income that is subject to US taxation. This credit is claimed using Form 1116 for individuals, enabling the taxpayer to reduce their US tax liability. Some states also permit the application of this credit on state tax returns, depending on state-specific regulations.

The U.S. has a Foreign Tax Credit (FTC) that allows U.S. taxpayers to claim a credit for income taxes paid to foreign countries, including India. This credit reduces the U.S. tax liability by the amount of foreign taxes paid, although it is subject to certain limitations and rules. If the FTC does not fully offset the U.S. tax liability, taxpayers might also be eligible to carry over or carry back the unused credit to other tax years.

Canada: Taxes paid in India are eligible for a foreign tax credit in Canada. This credit helps reduce the amount of tax payable to Canadian authorities, ensuring that taxpayers avoid double taxation. However, if the tax paid in India is lower than the equivalent Canadian tax, the Canadian tax authorities will collect the difference.

Canada also offers a Foreign Tax Credit to its residents, allowing them to claim a credit for income taxes paid to foreign countries, including India. This credit helps to reduce the Canadian tax liability on income that has already been taxed in India. The foreign tax credit is limited to the lesser of the actual tax paid to the foreign country or the Canadian tax payable on the same income.

However, in Canada, MF income is taxed on the general principle. Gains are taxed in the year of sale, and tax is levied at the highest marginal rate of 50%. However, the taxpayer can elect to pay a higher rate at the federal level and lower rate at the provincial level, depending on the province that the taxpayers live in. The highest rate of 54% is in Quebec. In that case, the applicable tax rate will be 27% on the overall gains, because only 50% of the actual capital gains are taxable. In Canada, there is no distinction between LTCG and STCG.

Nevertheless, it is advisable to consult a tax professional for detailed guidance tailored to your specific situation.

What is the grandfathering clause for the gains made on Investments ?

In the context of the U.S. and Canada, there is no automatic grandfathering clause that universally exempts capital gains on investments made before moving abroad. However, the tax treatment of such gains depends on several factors:

For the U.S:

- U.S. Tax Residents: The U.S. taxes its citizens and residents on worldwide income, including capital gains, regardless of where they live. If you become a U.S. tax resident, capital gains on investments made before moving to the U.S. are generally subject to U.S. taxation when realized.

-- Mark-to-Market Regime: If you relinquish your U.S. citizenship or long-term residency, you may be subject to an exit tax, which treats all your assets as if they were sold on the day before you leave, potentially taxing unrealized gains accrued before your departure.

For Canada:

Departure Tax: When you leave Canada and become a non-resident, Canada may impose a departure tax. This tax is based on the deemed disposition of most assets at their fair market value on the date of departure, meaning unrealized capital gains are taxed as if the assets were sold. However, certain assets, like Canadian real estate, may be excluded.

Foreign Tax Credit: If you later realize gains on investments made before moving to the U.S. or another country, Canada may allow a foreign tax credit to offset taxes paid in the new country of residence, but only to the extent of Canadian tax on that income.

While there isn't a specific grandfathering clause, the tax implications depend on when the gains are realized and the tax rules of the country you're moving to or from. Consulting with cross-border tax experts is recommended to navigate these complexities.

Details on Compliance Requirements?

United States:

Form 8621: U.S. taxpayers must fill out Form 8621, which requires information such as the number of mutual fund units owned, the total number of units in the fund, and its value at year-end. Taxpayers may need to report each mutual fund investment separately, including details about the underlying investments of each fund. Obtaining these details can be challenging and time-consuming, as they may not always be readily available.

Canada:

Capital Gains Reporting: In Canada, capital gains on investments in foreign mutual funds (like Indian mutual funds) are generally reported only when the units are sold.

Foreign Holdings Review: Occasionally, there may be a need to review the structure of foreign investments to determine if additional reporting is required. This review becomes mandatory for individuals with investments exceeding 100,000 Canadian dollars outside of Canada.

Canada: Individuals who are physically present in Canada for more than 183 days in a calendar year are deemed to be Canadian tax residents. An individual who spends less than 183 days in a year in Canada but has a ‘residential tie’ in Canada may be deemed a tax resident and taxed on a worldwide income in Canada.

CONCLUSION

Investing in Indian mutual funds as an NRI residing in the US or Canada involves navigating complex tax rules and rigorous compliance requirements. While there are options to manage tax liabilities, such as leveraging foreign tax credits and selecting the most advantageous PFIC reporting method, these choices require careful consideration and thorough understanding of both US and Canadian tax laws. NRIs must stay informed and, where necessary, seek professional advice to optimize their tax outcomes and ensure compliance, especially given the absence of grandfathering clauses and the potential for significant penalties for non-compliance.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts