A GUIDE TO MASTERING FINANCIAL PLANNING

- Sun Nov 10 18:30:00 UTC 2024

- In Fundas Of Finance by Aparna Bose

-EXPLORING THE FUNDAMENTALS OF WEALTH MANAGEMENT

Taking charge of your finances is one of the most empowering steps you can take towards achieving financial stability and independence. By actively managing your financial situation, you not only gain control over your immediate circumstances but also set the foundation for long-term wealth creation. To navigate this journey effectively, it's essential to delve into the core elements of financial planning, while recognizing that each individual's financial needs and goals are unique. Financial planning isn’t a one-size-fits-all solution

It’s crucial to tailor your financial approach to fit your unique circumstances, values, and goals. Your investment strategy should align with your risk tolerance, which takes into account your financial goals, time horizon, and comfort level with market fluctuations. Periodically review your investment portfolio to ensure it aligns with your financial goals and risk tolerance. Rebalance as needed to maintain your desired asset allocation.

It is important to customize your “Financial Plan”. Your financial needs may vary significantly depending on whether you are in your 20s, 30s, or nearing retirement. Adjust your savings and investment strategies accordingly to address major life events such as marriage, having children, or changing careers. Incorporate your personal values into your financial planning strategy. If philanthropy is important to you, consider setting aside a portion of your wealth for charitable giving.

And for those who are unsure about where to start or who have complex financial situations, consulting with a financial planner/ expert can provide valuable insights and personalized strategies. Seeking guidance from a knowledgeable person will help in organising and monitoring your money.

UNDERSTANDING THE BASICS

At its core, financial planning involves setting both short-term and long-term financial goals, assessing your current financial situation, and devising a clear strategy to reach those goals. Start by setting financial goals. We all have aspirations, whether it's buying a luxury car , acquiring a penthouse, a world tour or retiring in paradise. Always remember, it’s never too early or too late to start. Here are some points to consider:

1. ASSESS YOUR CURRENT FINANCIAL SITUATION:

Net Worth: Calculate your assets and liabilities to determine your net worth. This provides a snapshot of your financial health.

Cash Flow Analysis: Track your income and expenses to understand where your money is going. This will help identify areas for improvement.

At Investaffairs we begin this exercise by filling out a data sheet. Either the clients do it themselves or with our help and guidance. This basic drill is the first stepping-stone towards entering the world of investing , especially in mutual funds.

2. SET CLEAR FINANCIAL GOALS:

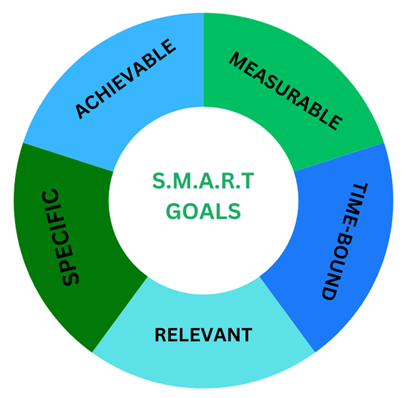

Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals. Whether it’s saving for retirement, buying a home, or funding your children’s education, having clear objectives will guide your planning process.

3. CREATE A BUDGET:

- Based on your cash flow analysis, develop a budget that allocates your income toward your expenses, savings, and investment goals. A well-crafted budget acts as a roadmap for your financial journey. You must seek an experts help in this regard if you do not have the expertise to allocate your money wisely and analysing the various schemes. Budgeting is like managing a virtual city with your finances. Allocate funds for various needs—like groceries, bills, and those tempting late-night cravings, movie outings etc. Adhering to your budget can be challenging, but staying on track is crucial.

4. BUILD AN EMERGENCY FUND:

- Aim to save three to six months’ worth of living expenses in a liquid account to protect yourself against unexpected financial setbacks. At Investaffairs we always insist on stashing away at least six months' worth of expenses in a liquid account for an unforeseen life event

Imagine this: you’re enjoying life—your monthly bills are paid, your savings are steadily growing, and you even have a bit of extra cash for occasional treats. Then, without warning, an unexpected expense strikes: a car breakdown, a medical emergency, or a sudden loss of income.

Without an emergency fund, this unforeseen event can feel like quicksand—each panic-fuelled thought dragging you deeper into worry and uncertainty. You scramble for solutions, anxiety creeping in as you consider tapping into savings set aside for other goals or, worse, maxing out your credit card, accumulating debt that could take years to repay. Your mind races through “What ifs”: What if I can’t pay my utilities? The pressure suffocates your peace of mind, making you feel trapped and overwhelmed.

As a mutual fund distribution firm, we urge you to prioritize building an emergency fund. This financial safety net provides a buffer against unexpected shocks, empowering you to face emergencies with calmness and clarity rather than panic. With three to six months' worth of living expenses — including your SIPs and EMIs—saved up, you’ll navigate financial storms with confidence, knowing you have resources to rely on. This safety net not only protects your finances but also supports your mental well-being. Imagine tackling an unexpected car repair without worrying about rent. You’d be empowered to seek the best job opportunities rather than rushing to accept the first offer that comes your way.

5.MANAGE YOUR DEBT

Develop a strategy for paying down high-interest debt. Prioritize debts based on interest rates and balances and consider consolidating or refinancing if it makes financial sense. Managing debt, particularly credit card debt, is also vital. Keep it under control before it grows beyond your reach. Understand loan interest rates and make timely payments to prevent debt from becoming a burden.

6.INVEST IN INSURANCE

Protect your financial future. Insurance is like a superhero, always there to save the day when the unexpected happens.

PLANNING FOR RETIREMENT

Think of retirement planning as preparing a time capsule for your future self. Financial planning ensures your wealth is preserved for future generations, keeping your legacy intact.

Planning for retirement involves a range of strategies and tools, including:

Savings Accounts: Regular and disciplined contributions to retirement accounts and financial vehicles like Mutual Funds can provide a nest egg that grows over time thanks to compound interest.

Investments: Diversifying your portfolio through stocks, bonds, and real estate can enhance growth potential while balancing risk.

Budgeting and Expenses: Understanding your expected expenses in retirement helps refine how much you need to save, allowing you to live comfortably without overspending.

Lifestyle Planning : While securing your financial future is vital, retirement is also about how you choose to spend your time. Considerations might include:

- Hobbies and Activities: Will you travel, take up new hobbies, or volunteer? Planning these aspects can provide joy and fulfilment in your retirement years.

- Community and Relationships: Maintaining social connections is crucial for emotional well-being. Think about how you'll stay engaged with family, friends, and community.

- Health Considerations: As you age, prioritizing health care and wellness can significantly impact your quality of life. Consider how you will manage healthcare expenses and maintain a healthy lifestyle.

RETIREMENT FUND : Building your retirement fund is the final piece of your retirement puzzle. It ensures that your wealth is preserved for your ‘needs’ and ‘wants’ arising during the sunset years and also for future generations so that your legacy remains intact. This process involves:

- WILLS AND TRUSTS: Create legal documents to outline the distribution of your assets after your death. Wills give straightforward instructions, whereas trusts allow for greater control over the timing and manner in which your heirs receive their inheritance.

- TRANSITION AND TRANSMISSION: Determine the amount you would like to provide for your children, grandchildren, or preferred charitable organizations. Doing so not only ensures their future well-being but also enables you to create a meaningful legacy. This entire process of transfer of units or transmission of investment is nicely regulated and streamlined in case of mutual fund investments. There are write-ups on our blog/ website on these topics. Please do have a read.

- HEALTHCARE DECISIONS: Planning for potential healthcare issues through directives and powers of attorney can ensure your wishes are honoured when you may not be able to communicate them yourself.

Maintaining Flexibility : Retirement planning is an ongoing process, not a one-time event. Regular reassessment is crucial, as unexpected changes like market fluctuations, health issues, or family dynamics may require adjustments. Revisiting your plan ensures it aligns with your current reality and future goals. It’s not just about accumulating wealth; it's about creating a fulfilling future and preserving your legacy. A thoughtful retirement plan shapes an exciting new chapter in your life while ensuring your investment portfolio and resources benefit future generations.

EXPLORING INVESTMENT OPTIONS

Let’s venture into the realm of investment options. Think of investing as embarking on a journey toward financial growth. Just as you plant seeds and nurture them to grow, investing involves putting your money into various opportunities to generate returns.

Before diving into investments, it's crucial to understand the options available: stocks, bonds, mutual funds, and real estate, each with its own risk and reward profile. Conduct thorough research and consider consulting a PERSONAL FINANACE EXPERT to guide your decisions. Or better still, come to us for goal planning and allocation.

DIVERSIFYING YOUR PORTFOLIO

Now that you’ve donned a costume and jumped into the investment pool, it’s time to splash around and talk about diversifying your portfolio. Instead of putting all your eggs in one basket, spread your funds across different asset classes and sectors. Just for the sake of drawing an analogy, let’s say, your go-to pizza place suddenly closes down, you still have a delicious biriyani or a butter chicken restaurant or some tasty luchi- kosha mangshow to fall back on!.

Think of your portfolio as a colourful plate filled with a variety of nutrients—fruits, veggies, proteins, cereals and grains. Not only does this approach serve as a safeguard against financial setbacks, but it also enhances your potential for success, just as a balanced meal keeps your energy high and your spirits lifted. So go ahead, mix it up, and create a flourishing investment feast!.

CONCLUSION

Mastering financial planning is akin to crafting a well-designed roadmap for your life’s journey. By setting clear, S.M.A.R.T goals, budgeting wisely, and consistently saving and investing, you lay a strong foundation for your financial future. The process doesn’t end there. Protecting your wealth with insurance, planning for retirement, and creating a robust emergency fund are crucial steps to shield yourself from life’s unforeseeable events. As you venture into investing, remember that diversification is key. Just as a balanced diet supports your health, a varied investment portfolio can safeguard against potential risks and boost growth opportunities. Financial planning, be it mutual funds or traditional investments, ensures that your hard-earned wealth benefits future generations and reflects your values.

Financial planning is an ongoing endeavour, requiring regular updates and adjustments to stay aligned with your evolving goals and circumstances. Embrace the journey with flexibility and foresight and take proactive steps to secure a fulfilling and prosperous future. By mastering these fundamentals, you’re not just managing your finances—you’re actively shaping a future where your aspirations and values thrive.

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts